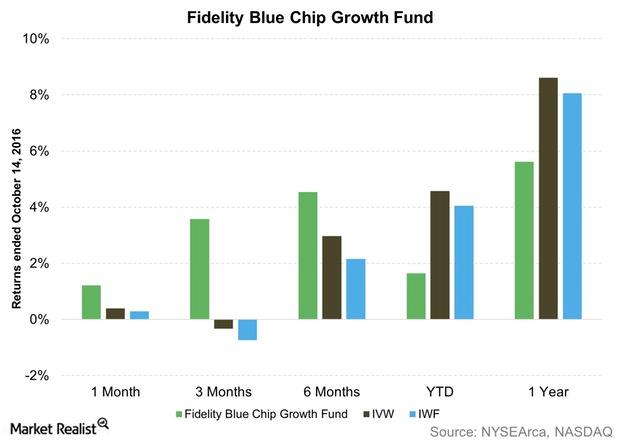

Over the past decade the Fidelity Blue Chip Growth Fund has returned an average of 1701 annually compared with 1607 for its benchmark the Russell 1000 Growth. The Fund normally invests.

Behind The Fidelity Blue Chip Growth Fund S Disappointing Performance In 2016

Behind The Fidelity Blue Chip Growth Fund S Disappointing Performance In 2016

View the latest Fidelity Blue Chip Growth Fund FBGRX stock price news historical charts analyst ratings and financial information from WSJ.

Fidelity blue chip growth fund review. Blue Chip Growth began trading in December 1987 and has a market value of 155 billion proving that theres still interest in trusting your portfolio to. Our investment approach focuses on companies we believe have above-average earnings. Blue-chip companies are well.

Fidelity Blue Chip Growth Fund seeks growth of capital over the long term by investing in common stocks of well-known and established companies both domestic and foreign. Fidelity Blue Chip Growth Fund seeks long-term capital growth. Insgesamt betrug die Performance in diesen 12 Monaten 2910 und die Volatilität lag bei 1650.

Registered investment adviser or Fidelity Institutional Asset Management Trust Company a New Hampshire trust company. Analyze the Fund Fidelity Blue Chip Growth Fund having Symbol FBGRX for type mutual-funds and perform research on other mutual funds. Learn more about mutual funds at fidelity.

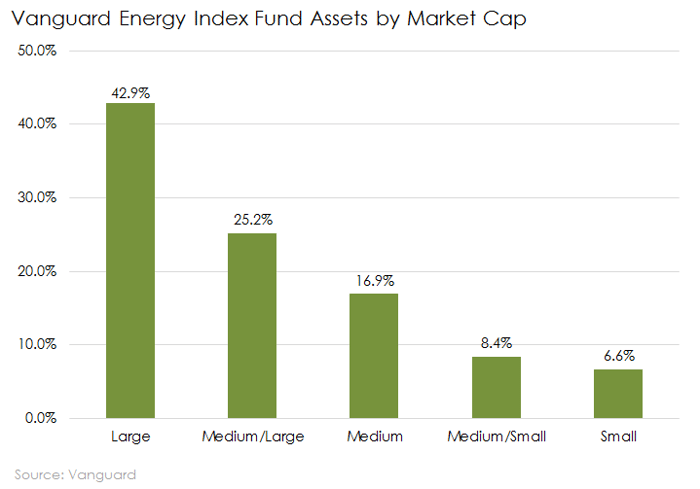

Fidelity Blue Chip Growth K6 Fund. QUARTERLY FUND REVIEW AS OF MARCH 31 2021 Fidelity Blue Chip Growth Fund Investment Approach FUND INFORMATION Fidelity Blue Chip Growth Fund is a diversified domestic equity growth strategy with a large-cap bias. The Fund seeks long-term growth of capital by investing at least 65 of total assets in domestic or foreign blue chip firms those with a market capitalization of.

Fidelity Blue Chip Growth quote is equal to 169110 USD at 2021-05-12. Overall Fidelity Blue Chip Growth FBGRX has a high Zacks Mutual Fund rank strong performance average downside risk and lower fees compared to its peers. The fund seeks long-term growth of capital.

If you are looking for funds with good return Fidelity Blue Chip Growth can be a profitable investment option. FIAM products and services may be presented by FDC LLC a non. Die Ausschüttungsart des Fidelity Funds - Euro Blue Chip Fund A Fonds ist Thesaurierend.

Fidelity Blue Chip Growth K6 FundOverview. According to Fidelity the fund was up about 28 in 2020 through July 31. Fidelity Institutional Asset Management FIAM investment management services and products are managed by the Fidelity Investments companies of FIAM LLC a US.

Normally investing at least 80 of assets in blue chip companies companies that in Fidelity Management Research Company LLCs FMR view are well-known well-established and well-capitalized which generally have large or medium market capitalizations. Based on our forecasts a long-term increase is expected the Fidelity Blue Chip Growth fund price prognosis for 2026-05-06 is 526757 USD. The Fund seeks long-term growth of capital by investing at least 65 of total assets in domestic or foreign blue chip firms those with a market capitalization of.

This blue-chip large growth fund targets companies in the SP 500 and Dow Jones Industrial Average and companies with at least 1 billion in market capitalization. Fidelity Blue Chip Growth Fund FBGRX earned the seventh spot in IBDs Best Mutual Funds list of top diversified growth funds in the third quarter of 2020 with a return of 17 by finding. From those criteria management.

The Fidelity Blue Chip Growth Fund has been one of the top-performing mutual funds both now and over the long term. The fund invests 80 of assets in blue-chip stocks.