This is the questions many home buyers are making these days and the answer is absolutely YES. CalPERS Home Loans 100 Financing Is it possible to still purchase a home in this market with no money down.

100 Financing Options With Calpers A Complete Guide To The Calpers

100 Financing Options With Calpers A Complete Guide To The Calpers

Origination fee set by CalSTRS at 125.

Calpers home loan. There was a program started in 1982 but it was discontinued in December 2010 due to several external factors including changing market conditions. One time free rate float down. How Does a Home Equity Loan Work.

CalPERS has not had a Member Home Loan program for several years. Following is a reference chart for FHAs mortgage program guidelines. The CalPERS Member Home Loan Program offers members security protection and choice when purchasing or refinancing a home.

Low income home programs fha home program government home programs calpers home program first time homebuyer programs ca cities low credit home programs first home program manufactured home programs Belgium and active. Qualifying for loans with the California Employee Loan program works the same way as getting qualified for any conventional or government loan program. FeaturesBenefits of a CalPERS Home Loan.

Editorials Calpers Home Loans. Home Loan Programs - If you are looking for a way to lower your expenses then use our options to help reduce payments. Towards the end of 2013 in an effort to fill this void in the market Mountain West Financial rolled out its CalPATH program.

CalPERS home loans assist members of CalPERS LRS JRSwith buying a home or a mortgage refinance at competitive mortgage rates preferred loan terms and discounted loan fees. We manage the largest public pension fund in the US. Httpwwwifundit CalPERS loans are no longer available since CalPERS has decided to suspend the 29 year old program.

Seller can concede up to 35 for closing costs. If you are a member of the CalPERS retirement system than you are one of the lucky home. The CalPERS Home Loan Program was discontinued in December 2010 due to several external factors including changing market conditions.

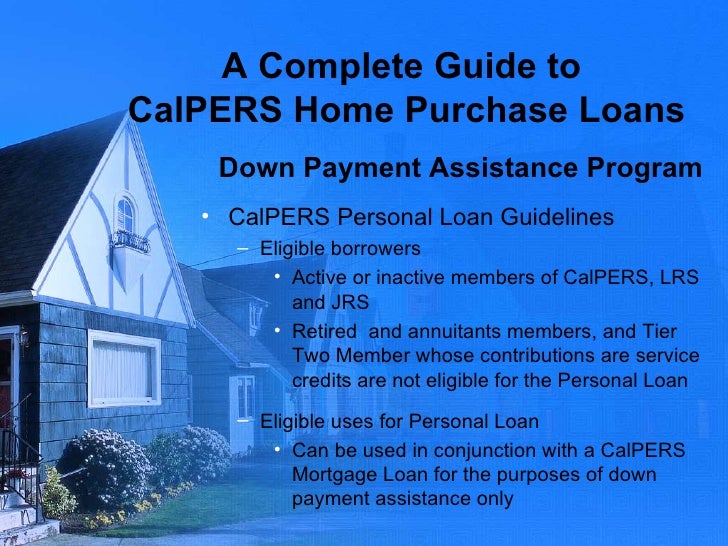

CalPERS the largest public employee pension fund in the nation suspended its home loan program in December of 2010. In addition to home loans some participants may qualify for personal loans which are secured by the participants contributions. Pre-Qualification can take as little as 15 minutes and the service is free.

Looking for a CalSTRS or CalPERS home mortgage loan. Calpers Home Loan Program Suspended It is recommended for financing major one-off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition. CalPERS offers the mortgage loans underwritten using HUDs insured FHA loan program to members in need of this type of financing.

Calpers Home Loan It is recommended for financing major one-off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition. It will include many of the familiar elements that made the CalPERS Member Home Loan Program so attractive such as. 100 financing 60 Day mortgage rate lockand the CalPERS mortgage rate roll-down benefit.

CalPERS launched its Member Home Loan Program in 1982 and offered benefits for members that included reduced lender fees lower closing costs and down payment assistance. CalPERS builds retirement and health security for California state school and public agency members. California Public Employees Retirement System - CalPERS.

This type of loan is available to anyone who owns their property. Interest rate is below market and set by CalSTRS cannot buy the rate down. But Ive Seen Home Loan Programs Advertised for CalPERS Members.

Students strapped for cash will be interested to hear about a new and exciting loan scheme - although instead of being provided with funds they are. CalPERS FHA underwritten loans are one the easiest loan to qualify for when buying or refinancing a home. Do NOT have to be a First time home buyer.

Cash strapped students offered baked bean loans. You can find the press release on the. Any home owner can apply for a home equity loan.

No up front and no monthly paid PMI. CalPERS home loans offer many advantages to CalPERS members such as. The home you are purchasing or refinancing must be in the state of California.

Competitive interest rates Streamlined processing. CalPERS members can still get a really low 30 year fixed rate loan to purchase or refinance an existing mortgage loan. Matt the Mortgage Guy is proud to offer the new CalPATH home loan to replace the CalSTRS and CalPERS home loan.

All active inactive and retired members of CalPERS the Legislators Retirement System the Judges Retirement System and the Judges Retirement System II are eligible to participate. With the CalPERS FHA program the rate for a 30 year fixed fully amortizing loan as of May 3 2010 was 4875 with an APR of 5231 according to the CalPERS. The main reason to take out a home equity loan is that it offers a cheaper way of borrowing cash than an unsecured personal loan.

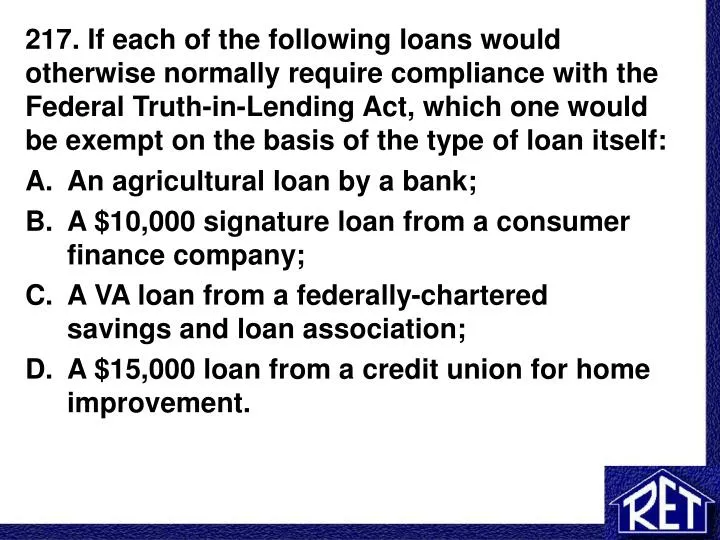

The Member Home Loan Program MHLP offered until December 15 2010 provided participants financing to assist in the purchase or refinance of a personal residence.