Non-network ATM Fee 0 National Average. Capstar has established itself as one of the most trusted mortgage lenders in Texas.

Mortgage Rates Capstar Lending

Mortgage Rates Capstar Lending

Capstar currently employs some of the most knowledgeable well-respected loan officers in Austin.

Capstar mortgage rates. In Austins competitive real estate market you need an advantage. The Bank of Waynesboro Merger. Regardless of which loan officer our clients work with they can rest assured that they are in expert hands.

Anzeige Österreichs großer Preisvergleich - brennen tuast weniga oist denkst. If you are considering buying or refinancing a home give me a call at 512-587-9936. 30-Year Fixed Rate Mortgage The most affordable option for most borrowers is the 30-year fixed rate mortgage.

In addition to personal consultations with our loan officers our clients benefit from in-house loan processing underwriting and closing all. 2002 richard jones road ste. You need Capstar Lending.

8 Zeilen Published rates and terms based on primary homes. CapStar Mortgage provides top quality high-touch service for borrowers needing commercial or residential mortgage financing. If you think you will sell or refinance before then its better to save the money at closing.

Purchasing a home is a significant investment. Our home loan options include. We are experts in manufactured housing financing and construction financing.

We specialize in providing FHA VA conforming non-conforming conventional reverse and jumbo loans for one-to-four unit properties. The First National Bank Merger. Whether you are financing your first home or your next one you need a mortgage lender with a proven track record.

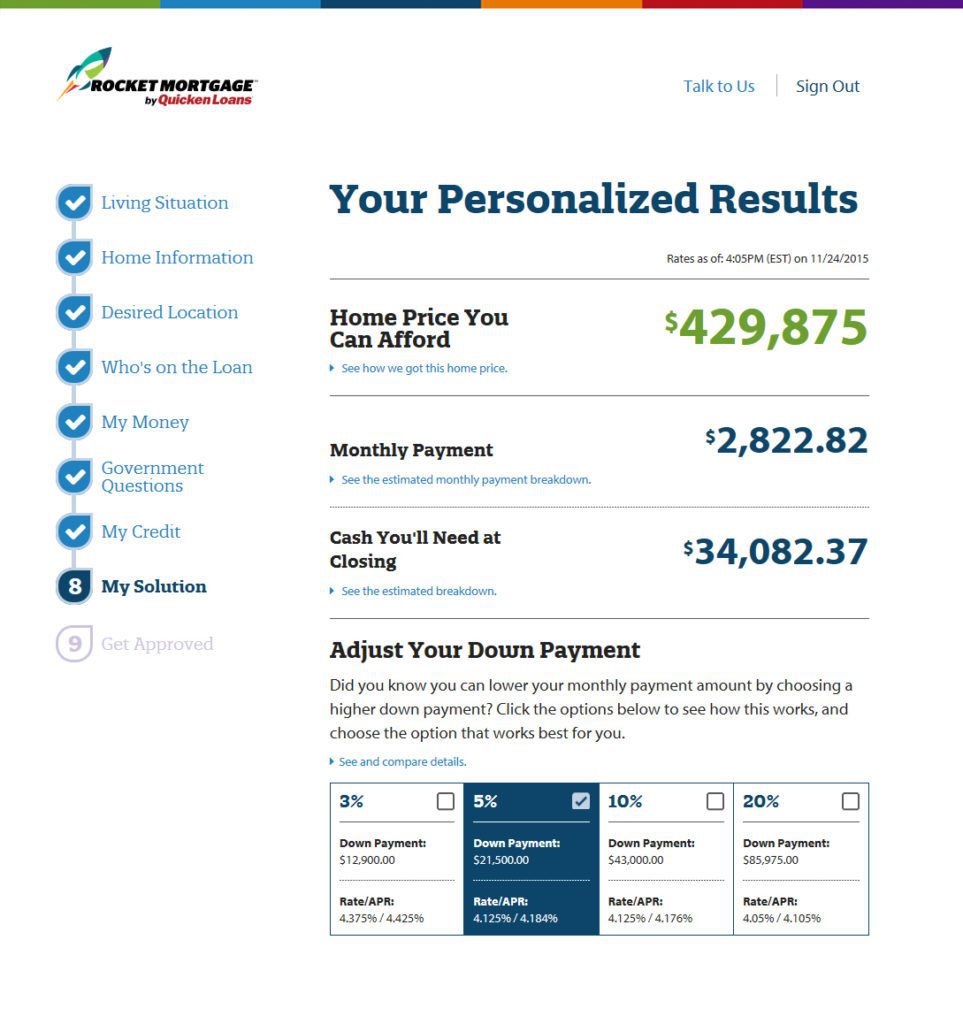

Calculates your maximum mortgage amount based upon the monthly payment interest rate. For those who will need cash in a pinch it is perfect because it charges no out-of-network ATM fees. 15-Year Fixed Rate Mortgage Borrowers can pay off their homes.

CapStar Bank refunds their out-of-network ATM charges which means handy access to cash at any time. Anzeige Österreichs Topangebote zu Capstar - jetzt stöbern Preishit finden. Monthly Fee 0 National Average.

Anzeige Österreichs Topangebote zu Capstar - jetzt stöbern Preishit finden. Capstar bank nmls 532633 nmls 532633. CapStar Bank has no responsibility for any external website.

Capstar Bank Rates Fees 2020 Review. You can look forward to consistent monthly payments for many years to come providing you with peace of mind and a consistent budget. Smart Start Financial Literacy.

Anzeige Österreichs großer Preisvergleich - brennen tuast weniga oist denkst. We neither endorse the information content presentation or accuracy nor make any warranty express or implied regarding any external site. Our Mortgage Loan Officers.

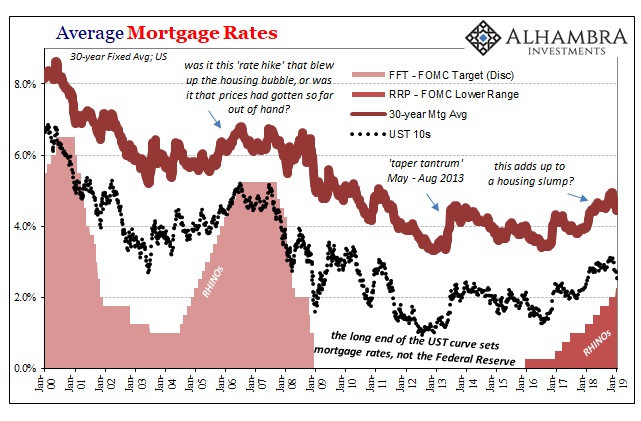

So if you are going to have the mortgage for more than 10 years then its worth getting the lower rate. With wholesale inflation measured year-over-year at around 120 recent PPI statistics mortgage bond investors appear to be being adequately rewarded today at a real rate of return after inflation that is above historical norms.