The race to the bottom for fund fees has finally hit well bottom. Zero Fee ETFs are just one of the newest ways that issuers are raising the bar in the so-called Fee Wars referring to the intense competition to drive down fund expense ratios.

Fzrox Vs Vti Does Fidelity S 0 Expense Ratio Make It A Better Choice Than A Vanguard Index Etf Mutf Fzrox Seeking Alpha

Fzrox Vs Vti Does Fidelity S 0 Expense Ratio Make It A Better Choice Than A Vanguard Index Etf Mutf Fzrox Seeking Alpha

This fund seeks to replicate the returns of both developed and developing international stocks.

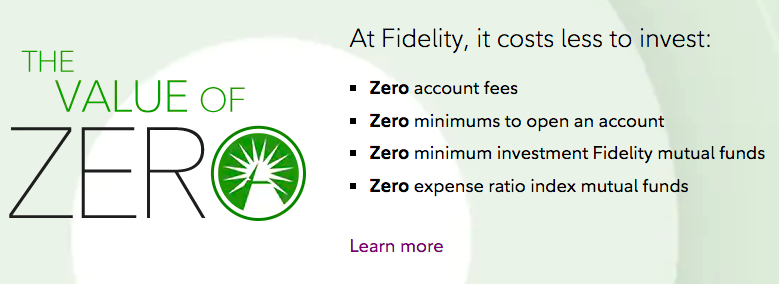

Zero fee etf. For EU-listed and UK-listed ETFs. After Fidelitys move we knew that a zero fee ETF would be launched very soon. Among the new ETFs waiting for final approval the BNY Mellon US Large Cap Core Equity ETF and BNY Mellon Core Bond ETF both come with a zero expense ratio or no annual fees.

The third no-management-fee fund is Fidelity ZERO International Index NASDAQ. Aggressive ETF flow is charged on a daily or weekly basis as follows. Fidelity launched two zero fee funds on August 1 st.

Offer an ETF that does not charge a management fee. 00025 USD per share with a minimum of 1 USD. Markets with only a few exceptions.

101 rows Vanguard Short-Term Inflation-Protected Securities ETF. Theres also a question of. Two exchange-traded funds that launched at the beginning of April charge 0 in expense ratios--at least for the first 14 months.

There are now 11. While the Salt Financial ETF is the only fund to reverse its pricing strategy four zero-fee ETFs launched by BNY Mellon and online personal finance company SoFi this year have gathered just 37m. Dont be fooled into thinking that these funds are.

Some ETFs carry a zero management fee. The Fidelity ZERO Total Market Index Fund NASDAQMUTFUNDFZROX and funds like it essentially invest in every single company listed on US. Zero Fee ETFs.

Should SoFis fee waiver expire investors in its zero-fee funds would be charged a 019 management fee. But we expected a free ETF from one of the major players in the asset management industry. The Race to Zero Fees Average ETF fees in the US.

Have tumbled around 40 over the last eight years as competition for market share has heated up and issuers respond to the growing demand for lower fee funds. 15 bps 0015 fee per trade value with a minimum of 15 EUR. Fidelity Investments became the latest discount broker to eliminate trading commissions following its rivals Charles Schwab E-Trade and TD Ameritrade.

Fidelity and Vanguard are breaking new ground in launching zero fee mutual funds and ETFs. Schwab receives remuneration from active semi-transparent ETFs or their sponsors for platform support and technology shareholder communications reporting and similar administrative services for active semi-transparent ETFs available at Schwab. Zero-fee ETFs typically make money by lending stock to clients selling other products or offering lower interest on cash funds.

In this case ETF issuers have done just that. 17 rows The first zero-expense-ratio ETF will launch in 2019 according to CFRA. Two exchange-traded funds that launched at the beginning of April charge 0 in expense ratiosat least for the first 14 months.

This fee will vary but typically is an asset-based fee of 010 per annum of the assets held at.