Take advantage of muni-bonds stealth yields. You wouldnt owe a single penny in federal or state taxes on these bonds if you were buying securities issued in your home state.

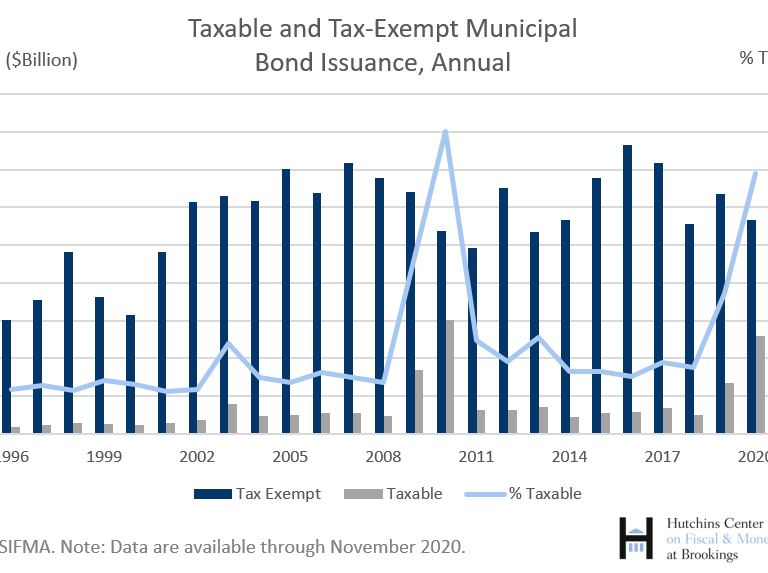

Why The Surge In Taxable Municipal Bonds

Why The Surge In Taxable Municipal Bonds

These muni bond funds offer tax-exempt income.

/municipal-bonds-what-are-they-and-how-do-they-work-3305607-FINAL-75578b195af448588b93a7fced720a97.png)

Tax free municipal bonds. Why are Muni Bonds Tax Free. With a 642 average return for the past 3 years and a 5-star Morningstar rating the Nuveen High Yield Municipal Bond Fund is a strong performer especially when you consider its tax-free earnings. Municipal bonds sometimes referred to as munis are issued by various government entities such as states counties and municipalities.

Submitted by Tax Free Municipal BondsFixed Income SpecialistsDRL Group on July 9th 2020 Get Email Updates Subscribe to receive FREE updates insights and more straight to your inbox. There is no implied backing from the federal government. Tax-free municipal bond interest is free from federal income tax but private activity municipal bond interest is subject to AMT.

Municipal bonds also known as munis are fixed-income investments that can provide higher after-tax returns than similar taxable corporate or. The advantage for issuers is that they receive a 35 federal rebate on interest costs for these bonds. Most municipal bonds are tax-free meaning that you dont have to pay federal tax on any income you make from the bonds returns.

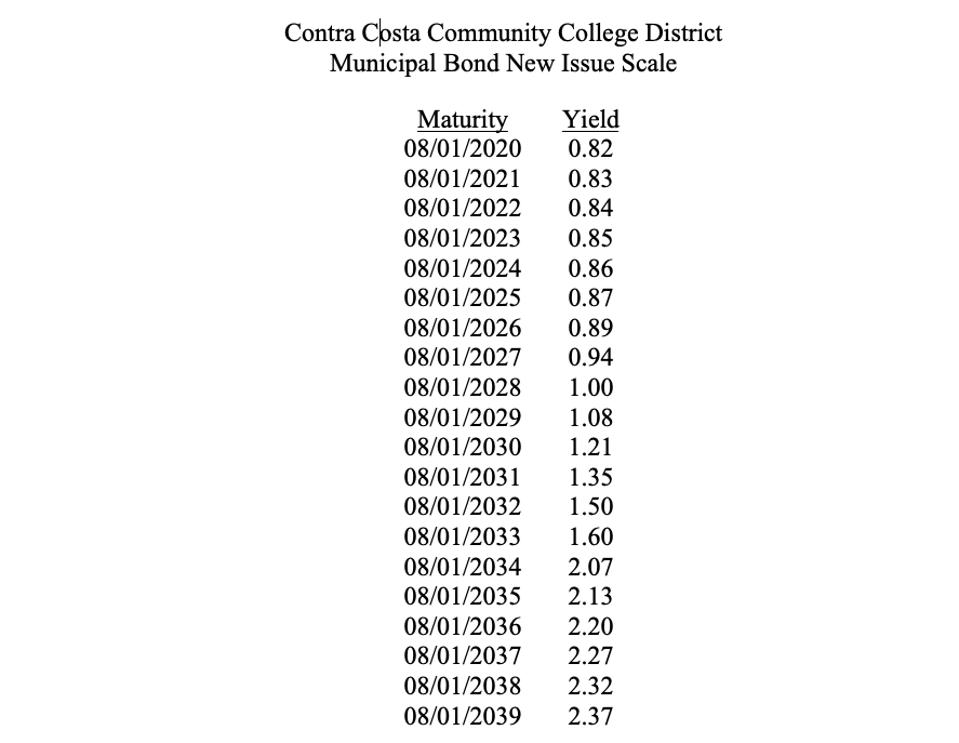

Municipal bond issues are a very popular way to earn tax-free income and if income is reinvested achieve tax-free compounding of returns. TEY tax-free municipal bond yield 1 - investors current marginal tax rate For example if an investor in the 35 tax bracket buys a tax-free muni bond. Build America Bonds BABs are a recent category of taxable municipal bonds introduced in the wake of the 2008 financial crisis.

Private activity municipal bonds are bonds used to finance bridges hospitals private universities and airports. Despite headline fears you may have read about muni defaults through the years in Puerto Rico for example theyre actually the safest bonds you. Taxable muni bonds generally yield more than tax-free bonds to make up for the difference.

At a minimum muni bond income is exempt from federal tax. Tax-free municipal bonds for individual investors We are municipal bond specialists and own the bonds we sell which enables clients to invest knowledgeably and with confidence. Taxable muni bonds generally yield more than tax-free bonds to make up for the difference.

Tax Equivalent Yield Tax-Free Yield 1 Tax Rate. If a person decides to buy a municipal bond he is lending money to his state or municipality in the amount of the bond he purchases. Theyre issued by cities counties and states to help fund regular operations in addition to special projects such as a new school or road.

Issuance of taxable munis has increased recently as a result of the 2017 tax law changes and low absolute yields. Heres how that calculation works. Private activity municipal bond interest is tax free unless the issue is a taxable municipal bond.

For example roughly 30 of the munis issued in 2020 were taxable. Tax-equivalent yield TEY is the yield that a taxable bond must hold to equal or exceed the tax-adjusted yield of a municipal bond. What Are Tax-Free Municipal Bonds.

Some munis are taxable. The tax-free municipal bonds on the other hand would generate 25000 per year in interest income. BABs only subsidize an issuers borrowing cost.

A municipal bond also known as a muni is debt security used to fund capital expenditures for a county municipality or state. For example roughly 30 of the munis issued in 2020 were taxable. Some munis are taxable.

Municipal bonds deliver tax-advantaged income to investors at regular intervals. You earn money in return for lending the money. Whether you buy your munis direct or through an ETF or CEF the dividends arent taxed by the.

These bonds are used to build things like roads schools and other public projects like stadiums and parks. Issuance of taxable munis has increased recently as a result of the 2017 tax law changes and low absolute yields. Municipal bonds or munis as they are sometimes known are debt securities.

And in some cases depending on where the bond was issued you might be exempt from state or local income tax as well.