Mortgage rates are set by the lender. 1 That affects short-term and variable interest rates.

4 Reasons Mortgage Rates Go Up And Down Fox Business

4 Reasons Mortgage Rates Go Up And Down Fox Business

Following is a brief explanation of the MBS market and how it works.

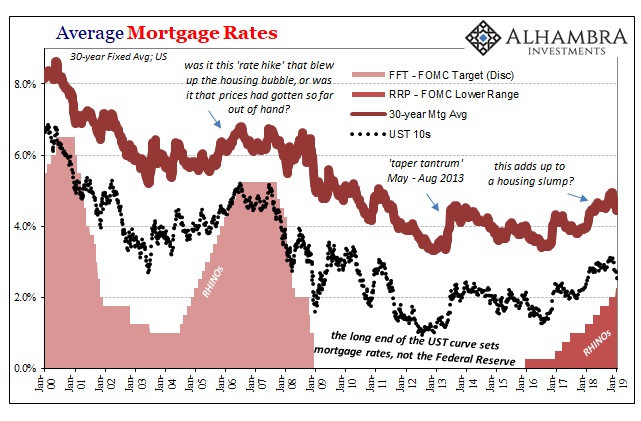

Who sets mortgage rates. The Fed can also increase mortgage rates by lowering the short-term discount rate prompting investors to sell off longer-term investments such as mortgage-backed securities. They are determined by three forces. Mortgage rates are determined not by the 10-year Treasury yield but by the mortgage bonds.

Current rates in Richardson Texas are 320 for a 30 year fixed loan 256 for 15 year fixed loan and 285 for a 51 ARM. Soon after closing theyre. In the US interest rates are determined by the Federal Open Market Committee FOMC which consists of seven governors of the Federal Reserve Board and five Federal Reserve Bank presidents.

While lenders in effect set their own mortgage rates how those rates are set is driven largely by the current rates of Mortgage Backed. These rates can be fixedmeaning the rate is set based on a benchmark ratefor the duration of the borrowers mortgage term or variable based on the mortgage terms and current rates. Although ARM rates are at all-time lows now you may still want to get a fixed-rate mortgage.

Your mortgages interest rate is set by market forces beyond the lenders control. The lender will consider a number of factors in determining a borrowers mortgage rate such as the borrowers credit history down payment amount or the homes value. However two concepts exist about mortgages that many people dont always understand.

Mortgage loan interest rates and the corresponding fees or points charged for various rates are driven by the prices of Mortgage Backed Securities MBS. The third force is the banking industry. Economy in 2020 the Fed said it would.

The rates constantly fluctuate based on economic elements such as inflation and job growth. Richardson TX Mortgage Rates. The federal funds rate is the interest rate banks use when making overnight loans to other banks to meet end-of-day requirements.

The Federal Reserve and mortgage rates have a very close relationship. See reviews photos directions phone numbers and more for Genpact Mortgage Services locations in Richardson TX. There are several factors at play when it comes to mortgage rates.

How are mortgage rates set. Mortgage interest rates are determined mostly on the secondary market where mortgages are bought and sold. Additionally what is the 30 year mortgage rate based on.

When the Federal Reserve commonly known as the Fed adjusts certain interest rates especially the federal funds rate this has an indirect effect on mortgage rates as well. 2 The second is investor demand for US. The first is how mortgage rates are determined followed by how those mortgage rates are affected when the US.

Rates rise and fall with the push and pull of the financial markets. The Federal Reserve doesnt set mortgage rates but sometimes the central banks decisions can influence them. For example the extraordinary rate rise to 1845 in 1981 was due to inflation caused by rising oil prices wages and more which pushed up the price of.

An adjustable-rate mortgage has lower rates and payments early in the term compared with a fixed-rate mortgage but rates can dramatically increase over the life of the loan. Not just markets within our borders. 1 day agoA 101 ARM sets your rate for a decade then your rate will fluctuate yearly.

Mortgage-backed securities MBS set the tone for mortgage rates The first thing to recognize is that most mortgages are owned by lenders for only a brief period. The first is the Federal Reserve which sets the fed funds rate. Mortgage interest rates are dependent on a variety of factors and while no one bank or government entity officially sets current mortgage rates the Federal Reserve Americas central banking system does wield plenty of influence.

3 That affects long-term and fixed interest rates. These home loans feature interest payments over a relatively short term of five to 10 years after which a lump sum payment is made. Federal Reserve Bank issues rate changes.

Treasury notes and bonds. No one not the President the Congress or the Federal Reserve sets mortgage rates. As the coronavirus pandemic hammered the US.