Commission-only wholesale mortgage reps earn higher commission rates at 50 and 60 basis points. Basis PointA basis point is a measurement of a percentage.

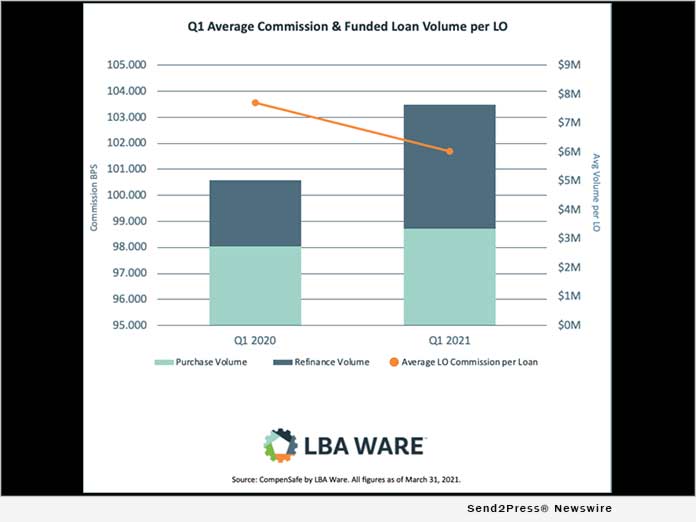

Lba Ware S Q1 2021 Mortgage Loan Compensation Report Shows Slight Decrease In Basis Points Paid Send2press Newswire

Lba Ware S Q1 2021 Mortgage Loan Compensation Report Shows Slight Decrease In Basis Points Paid Send2press Newswire

On average this compensation can range from roughly 50 basis points 050 of the mortgage amount for one-year terms to 110 basis points 110 of the mortgage amount for five year terms at prime lenders.

Basis points mortgage commission. This amount is based on a number of basis points. Its fair for consumers to question whether mortgage loan officers are acting in their best interests. For instance if a mortgages rate goes from 463 to 441.

The rate rises with an increase in volume. The term is frequently used to describe changes to interest rates. LBA Wares Q1 2021 Mortgage Loan Compensation Report shows slight decrease in basis points paid Despite lower BPS significant gains in year-over-year funded loan volume kept commissions sizable.

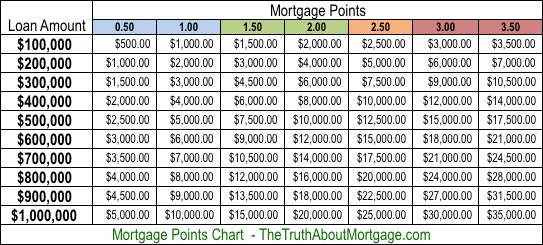

Each basis point is 1100th of one percent so 25 basis points or. However as noted in the post depending on the size of the loan lenders may need to charge more or less to cover their costs and make money. The loan officer and the mortgage company negotiate a commission rate as part of the employment process and the loan originator earns a set commission on all loans based on that agreement.

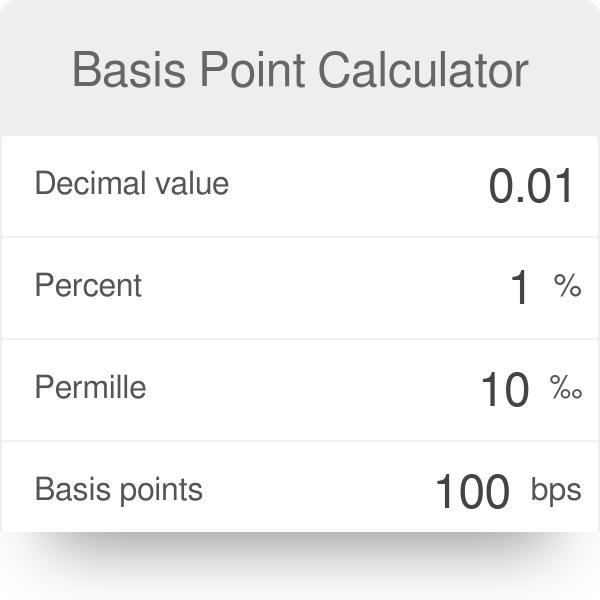

That means the interest rate was originally 325. A useful starting point is to ask. One basis point is equal to 1100th of 1 or 001 or 00001 and is used to denote the.

Lenders pay close attention to these numbers. Under Wells Fargos plan loan officers will now be receiving 43 basis points not per loan but rather for a monthly volume of up to 899000. As one basis point is equivalent to 00001 as a decimal you can quickly and easily convert basis points into a decimal by multiplying it by 00001.

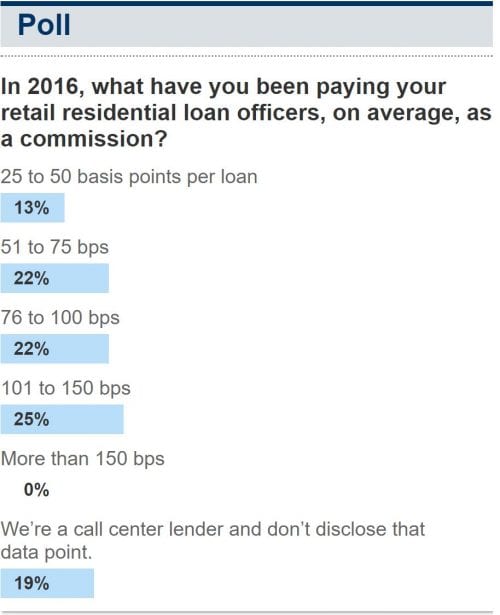

For example if a borrower requires a mortgage in the amount of 500000 to buy a house in the GTA and the mortgage agent mortgage broker can place the deal with TD Canada Trust then the bank will pay the broker a finders fee or commission. Each basis point is 1100 th of one percent so 76 basis points are just over ¾ of one percent. The poll results below from Inside Mortgage Finance show the range of commissions paid.

If youre talking about mortgage points for commission many banks will charge 1 point. And some may charge no points directly to the borrower. Commission comm Bank An agents fee for negotiating a real estate or mortgage loan transaction often expressed as a percentage of the selling price.

A basis point is equal to one-100th of a percent. At 60 basis points the commission on a 350000 mortgage loan would be 2100. Loan officers typically get paid in two ways.

It refers to the points that affect the interest rates a homeowner pays on a mortgage. 1100th of one percent. Basis points is a term often used in the mortgage industry.

Basis points BPS refers to a common unit of measure for interest rates and other percentages in finance. Incentives for selling certain financial products or reaching quotas. A typical Canadian mortgage agent is paid commission by the lender that he or she funds his or her borrowers mortgage through.

This means on a 100000 loan a loan officer would. As such the decimal and percentage equivalent of your mortgage. How are these loan officers compensated.

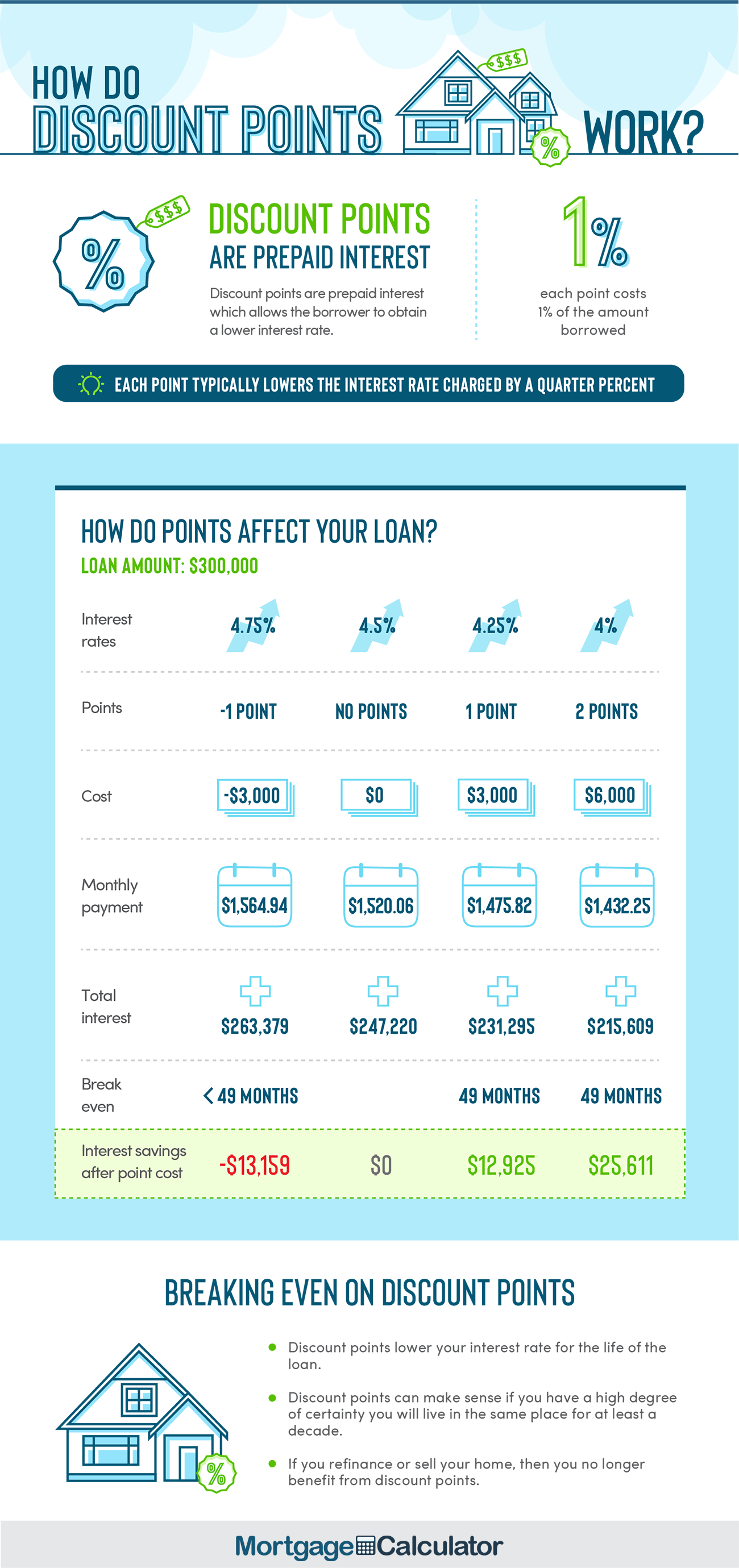

So it really depends. For example lets say the average mortgage rate fell 25 basis points remember a basis point is worth 001 and now its at 3. Remember basis points are used to describe changes in interest rates that means any changes even a fraction of a percentage can affect how much youll pay in monthly payments.

Commission rates for mortgage brokers vary widely depending on the lender the mortgage type the length of the mortgage term and so on. The additional 15 basis points that loan officers once received on government-insured loans also are being nixed. For example lets say your mortgage was charged at a rate of 150 basis points.

You can compute the basis points as a percentage by multiplying the basis points by 00001 150 00001 0015. One basis point is one-tenth of a percentage point A 100000 loan with a 50 basis point commission pays the loan officer 500. A change in points can increase or decrease the interest rate a consumer pays over the life of the loan.

Commission generally ranges from 50 to 100 basis points. In most cases basis points refer to. At 60 basis points the commission on a 350000 mortgage loan would be 2100.

Likewise a fractional basis point such as 15 basis points is equivalent to 0015 or 000015 in decimal form. Related Terms and Acronyms. At 19 million in monthly loan volume a loan officer will receive 63 basis points.

For example the difference between a 90 loan and a 95 loan is 50 basis points. Commission calculated as a percentage of the total loan amount 2. Just look for the best combination of points rate and fees to ensure youre getting the best.

Basis Points Mortgage Commission What Commission Do Wholesale Mortgage Reps Make

Basis Points Mortgage Commission What Commission Do Wholesale Mortgage Reps Make

What Are Mortgage Points The Truth About Mortgage

What Are Mortgage Points The Truth About Mortgage

Discount Points Calculator How To Calculate Mortgage Points

Discount Points Calculator How To Calculate Mortgage Points

Basis Points Bps Finance Unit Of Measurement 1 100th Of 1

Basis Points Bps Finance Unit Of Measurement 1 100th Of 1

Loan Officer Job Description Salary And What To Expect The Truth About Mortgage

Loan Officer Job Description Salary And What To Expect The Truth About Mortgage

Loan Originator Commissions Increase In Q1 Themreport Com

Loan Originator Commissions Increase In Q1 Themreport Com

How Much Do Mortgage Lenders Make On Your Mortgage Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Much Do Mortgage Lenders Make On Your Mortgage Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Today S Mortgage Interest Rates Dec 17 2020 Forbes Advisor

Today S Mortgage Interest Rates Dec 17 2020 Forbes Advisor

What Are Mortgage Points The Truth About Mortgage

What Are Mortgage Points The Truth About Mortgage

Loan Officer Commissions Soared In March But Future Not As Bright National Mortgage News

Loan Officer Commissions Soared In March But Future Not As Bright National Mortgage News

What Are Mortgage Points The Truth About Mortgage

What Are Mortgage Points The Truth About Mortgage

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.