California Municipal Bonds - May 7 2021. View municipal bond offerings from State of California Investor Relations and view bond ratings from Moodys SP and Fitch.

California S 1 4 Billion Deal Seen As Bellwether For Muni Primary Bond Buyer

California S 1 4 Billion Deal Seen As Bellwether For Muni Primary Bond Buyer

This announcement is neither an offer to sell nor a solicitation of an offer to buy these securities.

California municipal bonds. Because the Fund invests primarily in California municipal securities the value of its portfolio investments will be highly sensitive to events affecting the financial stability of the State of California and its municipalities agencies authorities and other instrumentalities that issue those securities. Muni California long portfolios invest at least 80 of assets in California municipal debt. The State of California Investor Relations website features bond offerings and ratings financial documents news updates about our municipality and other information about our municipal bond programs.

Foreign Corporate Bonds most major corporate debt in a county. California municipal bonds finance investments in roads schools parks public utilities housing publicly owned airports and seaports levees public facilities and other crucial construction and infrastructure projects in the state of California. PFD acts as agent for sale for revenue bonds issued by.

Find everything about California municipal bonds. These funds typically include revenue bonds and general obligation bonds with various maturity dates. Get a California Municipal Bond Quote.

Learn More MarketStructure Understand the basic. SECTION 7 CALIFORNIAS BOND CALENDAR Californias general obligation bond sales generally take place three to four times a year generally two sales each during the respective three to four months after the governors January budget release and after a budget is approved and signed in June. Risks of California Municipal Securities.

California muni bonds raise capital for the state to support the development of major infrastructure projects including schools roads bridges and housing. So municipal bonds are preferred by investors seeking a steady stream of tax-free income in a volatile market. California Municipal Bond A California Municipal Bond Funds and ETFs invests in debt obligations issued by a local government or entity in the state of California.

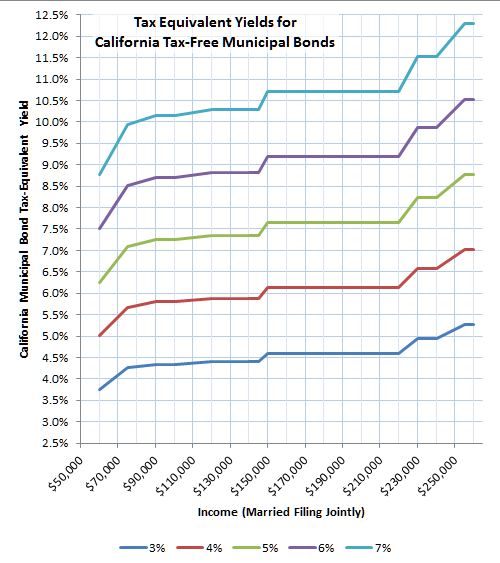

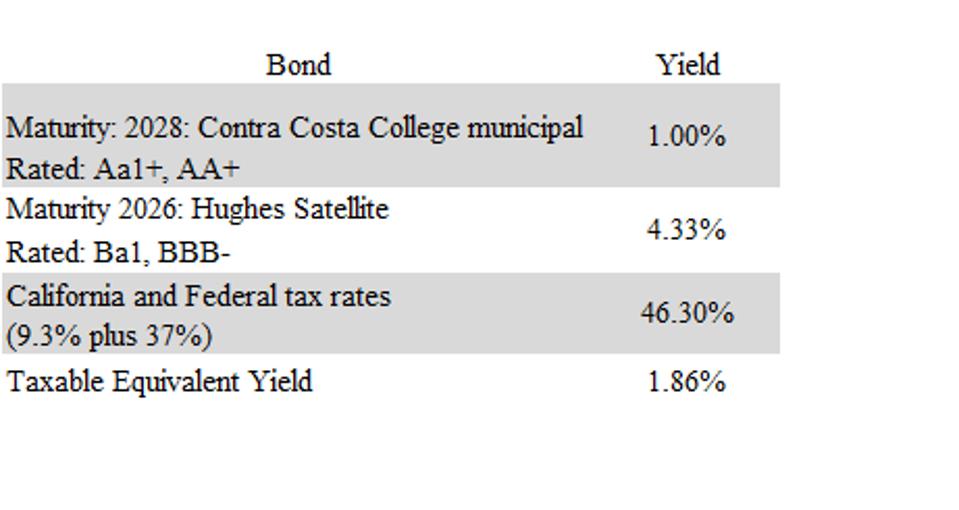

Because the income from these bonds is generally free from federal taxes and California state taxes. By purchasing a CA municipal bond you are purchasing debt from the state government to provide financing. Typically these types of muni bonds mature after 5-6 years and pay tax-exempt interest.

If you reside in any. To find out detailed information on California Municipal Bond in the US click the tabs in the table below. The Public Finance Division PFD manages the States debt portfolio overseeing the issuance of debt and monitors and services the States outstanding debt.

California Municipal Bonds Thank you for considering Wells Fargo Securities for your State of California municipal bond needs. California Municipal Bond Yields. However the American Century CA High Yield Municipal Bond Fund doesnt hold any US.

The following are the current options we provide you when you request a quote. Government and Corporate debt in US Dollars if available. California municipal bond mutual funds form one of the main segments in this.

Track CUSIPs learn about issuers and dive deep into every California municipal bond. The offering of these securities is. California the home of the worlds fifth largest economy told prospective buyers of the 22 billion of general-obligation bonds that will be sold next week that a.

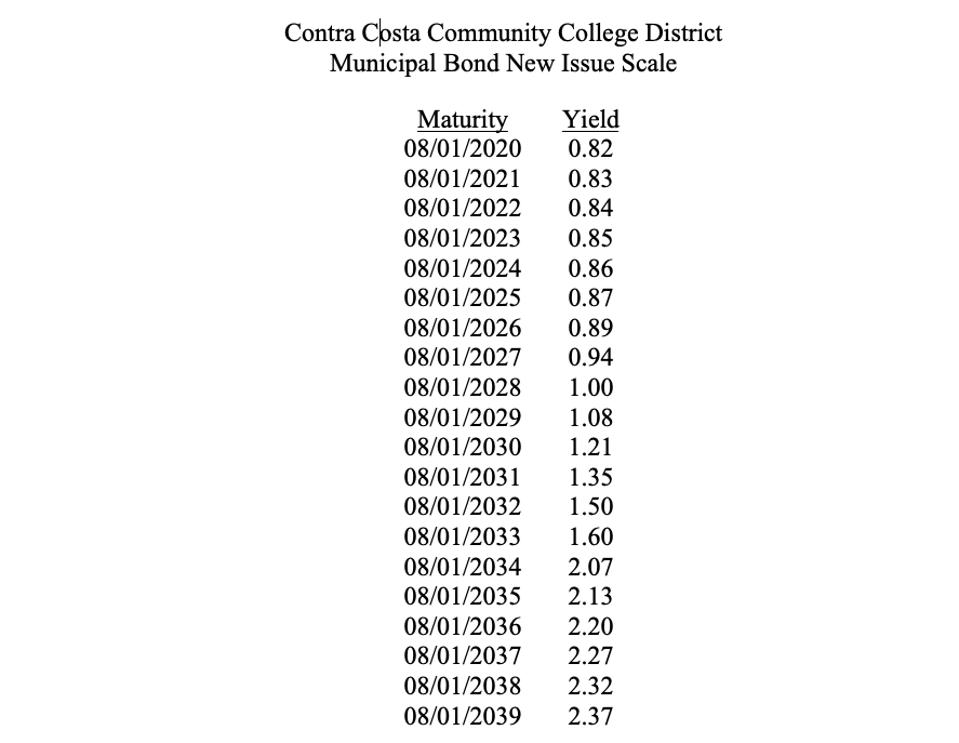

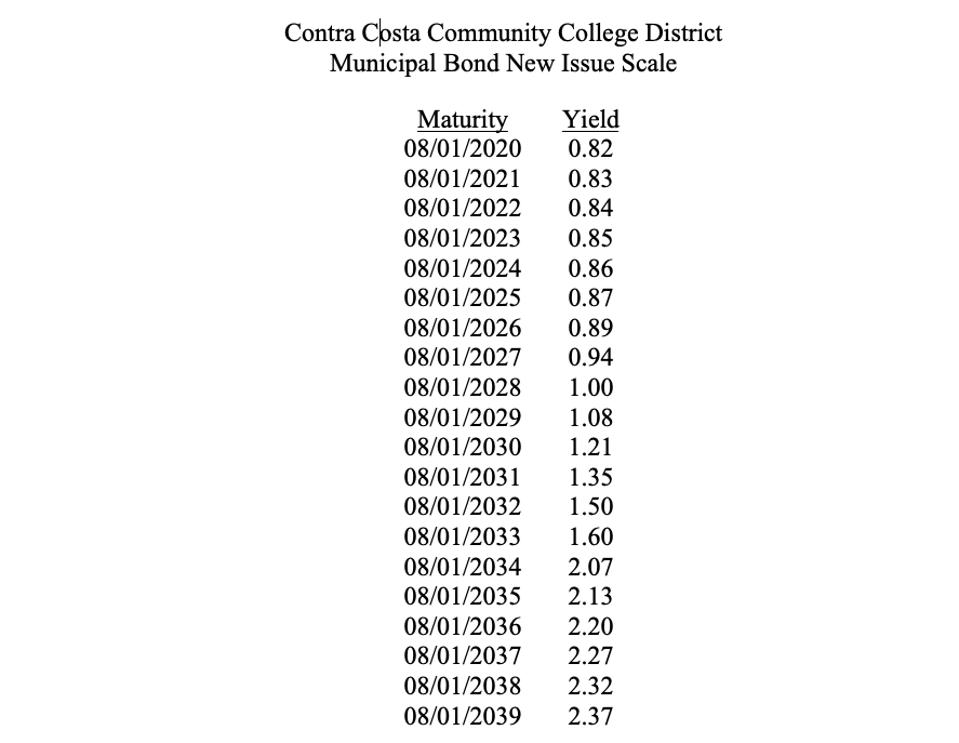

Government Bonds in most major countries. The rapidly growing population created demands for improved infrastructure housing water and transportation systems. Go out of California and a comparable quality 2028 bond yields roughly 180-185.

As a California municipal bond investor myself these chokingly low yields are unacceptable. Thats a lot of investors holding a whole lot of bonds. California State Treasurer Chiang Sells.

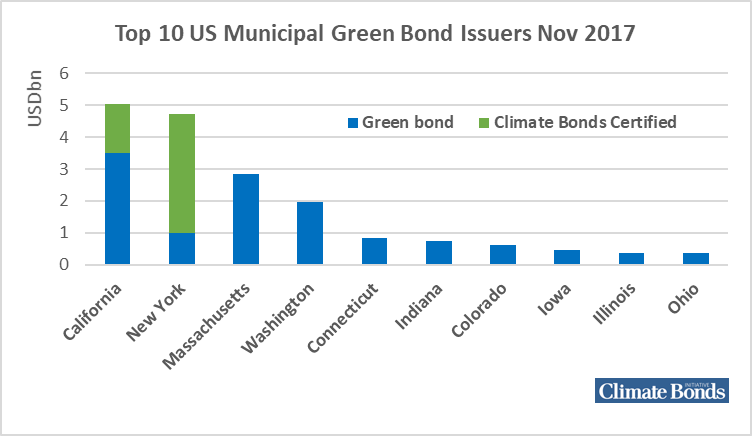

In total its estimated some 482 billion in bonds are outstandingjust over 12 of the total municipal bond market. California Municipal Bond Market History The story of the California municipal bond market begins in the early 1900s after the gold rush of the 1850s brought so many Argonauts to the state in search of gold. Like the Nuveen CA High Yield Municipal Bond Fund the funds strategy is to invest in high yield municipal bonds that are exempt from federal and California income taxes while maintaining low exposure to the alternative minimum tax or AMT.

PFD handles the sale of general obligation bonds revenue bonds including lease revenue short term notes and commercial paper.

Best Tax Free Municipal Bonds Bond Funds Of 2021 Benzinga

Best Tax Free Municipal Bonds Bond Funds Of 2021 Benzinga

State Of California Unemployment Relief Bond Act Of 1933 Issued During Depression California 1934

State Of California Unemployment Relief Bond Act Of 1933 Issued During Depression California 1934

California Municipal Green Bond Issuance Passes 5 Billion New Us Green Finance Record Climate Bonds Initiative

California Municipal Green Bond Issuance Passes 5 Billion New Us Green Finance Record Climate Bonds Initiative

Avoid Muni Bonds Issued By New Jersey California And New York Invest Elsewhere

Avoid Muni Bonds Issued By New Jersey California And New York Invest Elsewhere

Tax Free Income For Those Who Need It Most California Municipal Bond Cefs Seeking Alpha

Tax Free Income For Those Who Need It Most California Municipal Bond Cefs Seeking Alpha

Municipal Bonds The Current State Of The States And A Path Forward Seia

Municipal Bonds The Current State Of The States And A Path Forward Seia

The Definitive Resource For California Municipal Bonds

The Definitive Resource For California Municipal Bonds

/Municipal-bonds-investing-for-income-benefits-35598aefcf37427cad5d206750833699.png) Benefits Of Investing In Municipal Bonds For Income

Benefits Of Investing In Municipal Bonds For Income

Municipal Bonds Where We See Value Now Lord Abbett

Municipal Bonds Where We See Value Now Lord Abbett

This Is The Worst Investing Mistake You Can Make Right Now

This Is The Worst Investing Mistake You Can Make Right Now

Municipal Bonds How Much To Hold Cfa Institute Enterprising Investor

Municipal Bonds How Much To Hold Cfa Institute Enterprising Investor

California Municipal Bond Investors Must Do This While They Stay At Home

California Municipal Bond Investors Must Do This While They Stay At Home

Tax Free Income For Those Who Need It Most California Municipal Bond Cefs Seeking Alpha

Tax Free Income For Those Who Need It Most California Municipal Bond Cefs Seeking Alpha

Avoid Muni Bonds Issued By New Jersey California And New York Invest Elsewhere

Avoid Muni Bonds Issued By New Jersey California And New York Invest Elsewhere

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.