Alternatively to access a full list of the current private debt funds in market click on the button. Below are the ten largest private debt funds in market by target size.

An Overview Of Private Debt Technical Guide Pri

An Overview Of Private Debt Technical Guide Pri

Finally in 2012 the Decreto Legge DL.

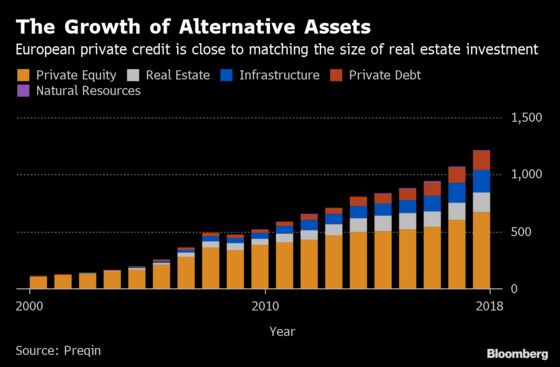

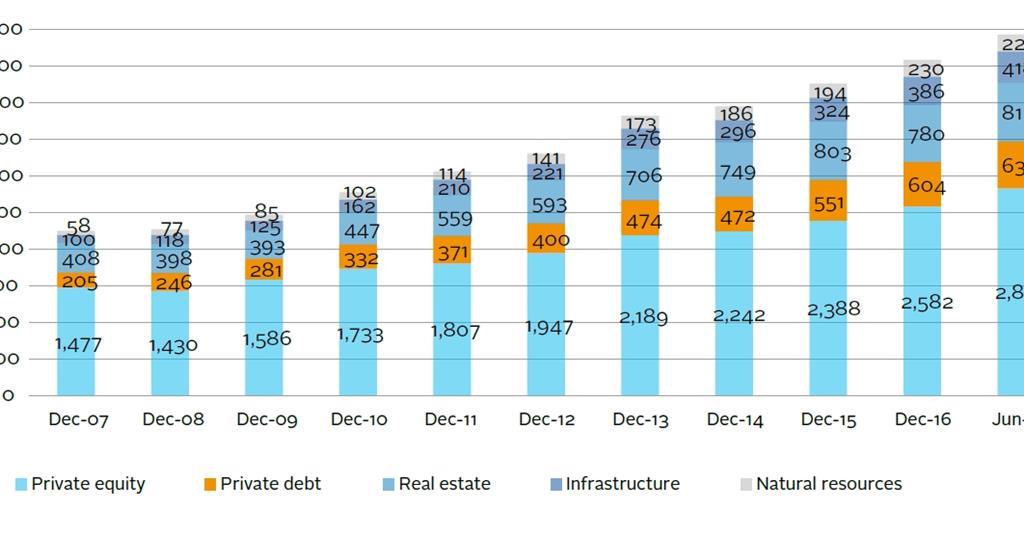

Private debt market size. Private debt assets under management soared to an all time high in 2017 according to data provider Preqin. The private-debt industry has grown to almost 770 billion in assets under management as of June from 275 billion in 2009 according to a report from Preqin. More investors believe that private markets have become effectively required for diversified participation in global growth.

In 2015 the European private debt funds managed to raise 41 billion euros. To view more data on each one click on the individual fund name or fund manager in the table below. Private financing can cost 125 percentage points more in annual interest than a more public leveraged loan made by banks and sold to dozens of money managers a market that is more than 13.

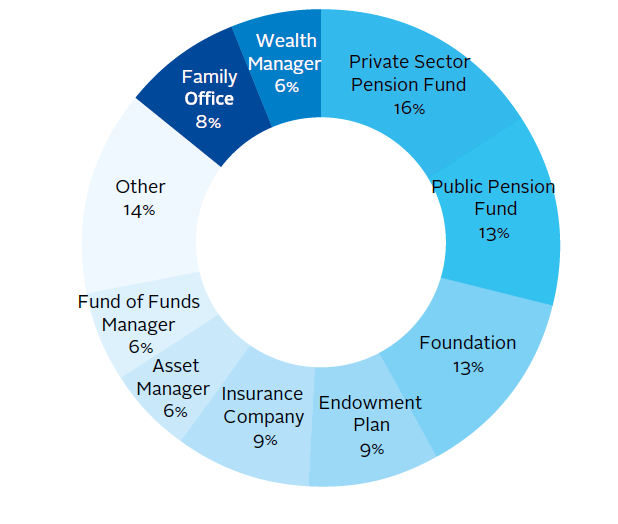

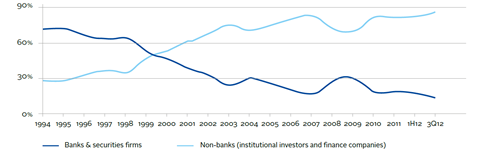

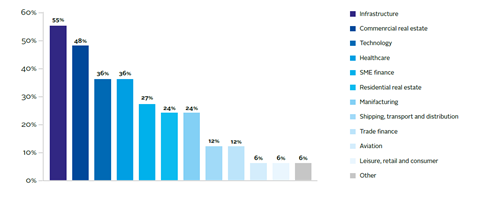

832012 made private debt investments a source of alternative funding. But 778 billion of new capital flowed in. Fund Managers 30 When the Check Alone Isnt Enough Alex Schmid ESO Capital 31 The Expanding Fund Manager Universe.

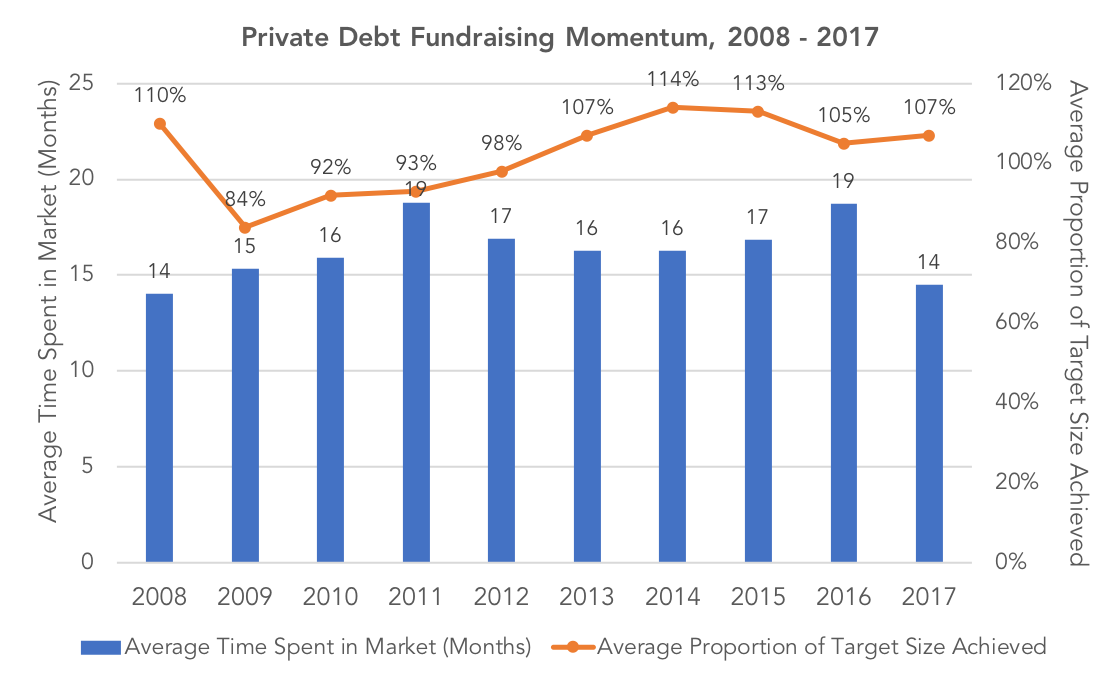

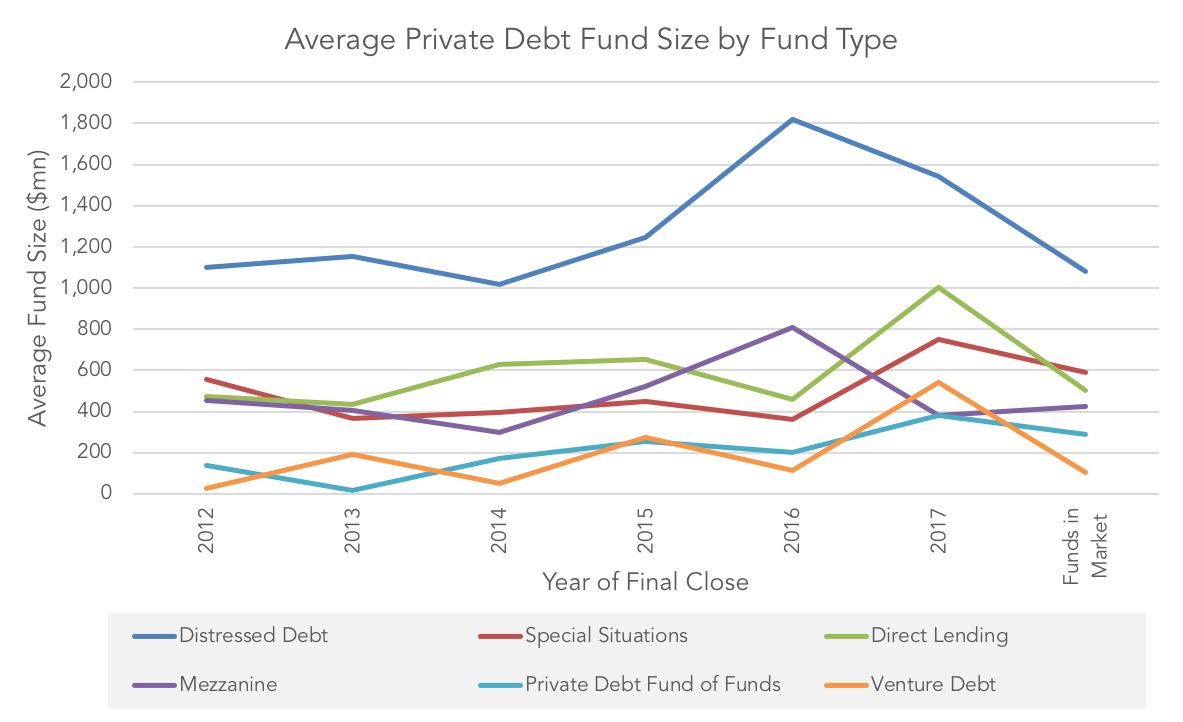

Average deal size grewfrom 126 million in 2016 to 157 million in 2017 a 25 percent increaseand managers accrued yet more dry powder now estimated at a record 18 trillion. Sponsored loans in 1Q 2019. The average size of closed-end private debt funds rose to a record high of 540 million in 2018 Preqin said.

Private debt fundraising surpassed 100bn in aggregate capital raised by funds closed in 2017 doing so for the first time. Minimum size and ratings requirements Costs associated with registration process. Private Debt 23 Funds in Market Reach All-Time High 25 Chinas Real Estate Market Offers Promising Distressed Debt Opportunities Xiaolin Zhang Zheng Zhang Lakeshore Capital 27 In Focus.

Fund size of 427mn. Direct lending funds alone closed last year raising more than 50bn. 2018 where we saw a decline in the market size estimates for several markets United Kingdom Australia Italy Belgium Norway South Africa Taiwan Ireland Malaysia and New Zealand.

But the environment for new lenders is. Not have access to or choose not to access the public debt markets due to. Private markets stayed strong in 2018.

In fact back in 2000 the private debt market was merely US43 billion. Private debt market grows to record size. Asia-focused funds accounted for 9 of all private debt funds closed in 2017 three-percentage points higher than in 2016.

The SMEs network is the backbone of Italian economy most of these firms are export oriented and an excellent opportunity for a private debt fund. A market size increase of 2718 billion. Demystifying the Private Placement Debt Market October 15 2012.

True fund-raising was down 11 percent. At June 2019 it was estimated to be a US800 billion market and on track to achieve a market size of US1 trillion in the not too distant future. The Rise of Asian Private Debt 4.

The Carlyle Group is a private equity firm and business development company that originates structures and acts as lead equity and debt investor in leveraged buyouts management-led buyouts strategic minority equity investments equity private placements consolidations buildups and growth capital financing. Investors have a new motivation to allocate to private markets. According to a report from Preqin published in November private debt is expected to be one of the fastest-growing asset classes with AUM increasing at a CAGR of 114 over the next five years to 146tn by 2025.

Interestingly there was an increase in the absolute market size estimates across all markets for 2019 vs. The mature and competitive private debt markets in North America and Europe credit markets in Asia offer a relatively untapped reserve of opportunity and with. The largest funds in the market globally are managed by Cerberus Capital Management LP TCI Real Estate Partners Bridge Investment Group Torchlight Investors LLC and Walton Street Capital LLC.

Private Debt Intelligence 2 12 2018 The Lead Left

Private Debt Intelligence 2 12 2018 The Lead Left

Private Debt Comes Of Age With Emerging Secondaries Market

Private Debt Comes Of Age With Emerging Secondaries Market

Bluebay Swept Up By Wave Of Divorces In Private Debt Market

Bluebay Swept Up By Wave Of Divorces In Private Debt Market

Private Real Estate Debt The Pandemic S Impact And The Industry S Future

Private Real Estate Debt The Pandemic S Impact And The Industry S Future

Payment Problems Rise In Fast Growing Private Debt Market Wsj

Payment Problems Rise In Fast Growing Private Debt Market Wsj

An Overview Of Private Debt Technical Guide Pri

An Overview Of Private Debt Technical Guide Pri

How Private Credit Soared To Fuel Private Equity Boom Bloomberg

How Private Credit Soared To Fuel Private Equity Boom Bloomberg

An Overview Of Private Debt Technical Guide Pri

An Overview Of Private Debt Technical Guide Pri

The Heisenberg Report Blog Private Parts Explosion In Private Debt Market Cements Liquidity As The New Leverage Talkmarkets Page 2

The Heisenberg Report Blog Private Parts Explosion In Private Debt Market Cements Liquidity As The New Leverage Talkmarkets Page 2

Private Debt Industry Assets Approach 600 Billion Valuewalk Premium

Private Debt Industry Assets Approach 600 Billion Valuewalk Premium

An Overview Of Private Debt Technical Guide Pri

An Overview Of Private Debt Technical Guide Pri

Private Markets Diversifying For The Future Russell Investments Commentaries Advisor Perspectives

Private Markets Diversifying For The Future Russell Investments Commentaries Advisor Perspectives

Private Debt Intelligence 1 22 2018 The Lead Left

Private Debt Intelligence 1 22 2018 The Lead Left

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.