Open demo account in 5 min. TVIX VelocityShares Daily 2x VIX Short-Term ETN.

The New Tvix Another 2x Leveraged Vix Etf Could Be Coming Etf Focus On Thestreet Etf Research And Trade Ideas

The New Tvix Another 2x Leveraged Vix Etf Could Be Coming Etf Focus On Thestreet Etf Research And Trade Ideas

Es gibt 1 ETF Sparplan-Angebot e bei Online Brokern für den Lyxor SP 500 VIX Futures Enhanced Roll UCITS ETF - Acc.

Leveraged vix etf. Anzeige Trade VIX index CFD. For instance if the VIX index value rises by 15 percent the 2x leveraged VIX ETF will rise by 3 percent during the same time period. It is important to note that none of the options futures or ETNs linked to the VIX offer exposure.

The VIX also known as the fear index is a widely followed indicator of equity market volatility. Der ETF ist älter als 5 Jahre und in Luxemburg aufgelegt. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk consequences of seeking daily leveraged or daily inverse leveraged investment results and intend to actively monitor and manage their investment.

Testsieger Depot 052021 - Kostenlose Aktiensparpläne - riesige Auswahl an ETF-Sparplänen. Anzeige ETF-Sparpläne ohne Orderkosten Gebühren besparen - ETF-Depot in 5 Min. There are 3 VIX ETFs that trade in the US excluding inverse and leveraged funds as well as those with under 50 million in assets under.

27 Zeilen Leveraged 3X ETFs are funds that track a wide variety of asset. The Chicago Board Options Exchange Market Volatility Index VIX also known as the markets fear gauge is the most widely used benchmark of volatility. Anzeige Trade VIX index CFD.

In fact any investment with a downward bias -- VIX ETFs leveraged ETFs and any other futures-based ETF product -- is generally not a good idea for investors with a. Leveraged Inverse and More Short-Term VIX ETNs. Inverse VIX ETFs make use of complex.

Anzeige ETF-Sparpläne ohne Orderkosten Gebühren besparen - ETF-Depot in 5 Min. VIX ETF Options. Inverse VIX ETFs are the exchange-traded funds that attempt to provide returns which are inverse of those realized from the VIX index.

VolatilityShares recently filed for the VolatilityShares 2x Long VIX Futures ETF in hopes of filling the gap left open by the 1 billion. ETFsETNs in each group are ordered by liquidity average trading volume from the most liquid to less liquid. VIX ETFs and ETNs by Exposure.

UVXY ProShares Ultra VIX Short-Term Futures ETF. The metric calculations are based on US-listed Volatilities ETFs and every Volatilities ETF has one issuer. 72 of retail lose money.

72 of retail lose money. 2x Long Leveraged Short-Term VIX Futures. The other types of VIX ETFs are the leveraged ETFs which aim to amplify the returns generated by the VIX index.

The use of leverage by a Fund increases the risk to the Fund. ETF issuers who have ETFs with exposure to Volatilities are ranked on certain investment-related metrics including estimated revenue 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields. These ETFs provide leveraged exposure to the SP 500 VIX Short-Term Futures Index inverse leveraged exposure to the Nasdaq 100 and leveraged exposure to the Nasdaq 100 respectively.

Open demo account in 5 min. These ETNs offer investors the opportunity to invest in contracts that are several months out as. Testsieger Depot 052021 - Kostenlose Aktiensparpläne - riesige Auswahl an ETF-Sparplänen.

Das günstigste Angebot kostet 250 Euro Ordergebühren für eine Sparrate von 100 Euro. VIX the CBOE Volatility Index is a standard index that tracks the volatility at the market level. This ETF offers leveraged exposure to an index comprised of short-term VIX futures contracts making it a very powerful tool for those looking to implement sophisticated strategies requiring exposure to the VIX.

1x Long Unleveraged Short-Term VIX Futures.

Don T Use Vix Etfs To Bet On Volatility The Motley Fool

Don T Use Vix Etfs To Bet On Volatility The Motley Fool

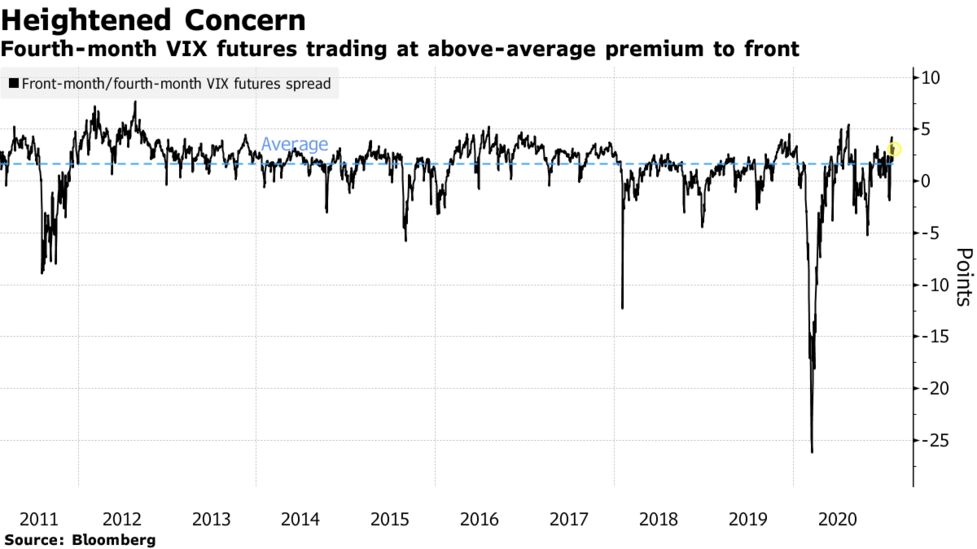

Vix Bets Shows Volatility Concerns Ebbing But Not Forgotten Bloomberg

Vix Bets Shows Volatility Concerns Ebbing But Not Forgotten Bloomberg

Wisdomtree S P 500 Vix Short Term Futures 2 25x D Etf Ie00blrprh06

Understanding Vix Etfs Careful What You Wish For Etf Com

Understanding Vix Etfs Careful What You Wish For Etf Com

Vix Index What It Is How It Works And How To Trade It

Vix Index What It Is How It Works And How To Trade It

Understanding Spiking Vix Etfs Etf Com

Understanding Spiking Vix Etfs Etf Com

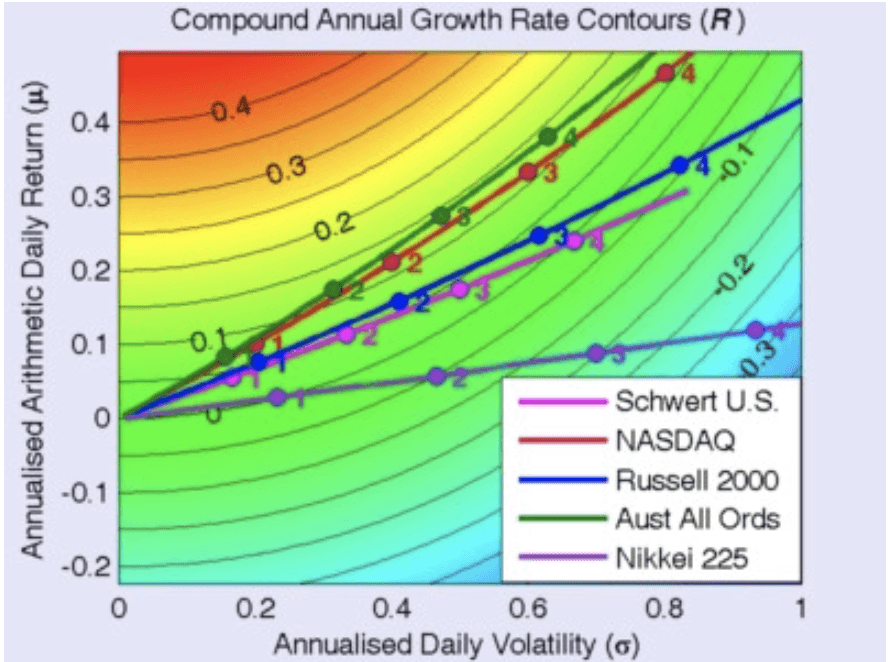

Leveraged Etf Investors Are Ignoring Volatility At Their Peril Seeking Alpha

Leveraged Etf Investors Are Ignoring Volatility At Their Peril Seeking Alpha

3 Vix Etfs To Fade The January Bounce

Volatility Blow Up Leads To Inverse Vix Etn Casualty Etf Strategy Etf Strategy

Volatility Blow Up Leads To Inverse Vix Etn Casualty Etf Strategy Etf Strategy

Understanding Vix Etfs Careful What You Wish For Etf Com

Understanding Vix Etfs Careful What You Wish For Etf Com

The New Tvix Another 2x Leveraged Vix Etf Could Be Coming Etf Focus On Thestreet Etf Research And Trade Ideas

The New Tvix Another 2x Leveraged Vix Etf Could Be Coming Etf Focus On Thestreet Etf Research And Trade Ideas

Options On Leveraged Vix Etfs Legal Issues Seeking Alpha

Options On Leveraged Vix Etfs Legal Issues Seeking Alpha

How To Short The Vix Without Blowing Up Your Entire Portfolio Backtesting A Hedged Short Vxx Portfolio Nasdaq

How To Short The Vix Without Blowing Up Your Entire Portfolio Backtesting A Hedged Short Vxx Portfolio Nasdaq

3 Vix Etfs To Fade The January Bounce

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.