The Federal Reserve said on Friday it would again lower the minimum loan size for its pandemic-era small business program. Additionally over 70 percent of respondents answering a special question related to the COVID-19 pandemic cited the use of loan.

Ppp Loans More Common In States With Existing Bank Relationships Fed

Federal reserve banks of.

Federal reserve small business loans. However there is substantial heterogeneity across neighborhood types in small business loan growth since 2010. Governments have begun offering small business loans with attractive interest rates and repayment terms in order to help smooth cash flow and retain employees. The Federal Reserve encourages financial institutions to consider participating in programs administered by the Small Business.

WASHINGTON Reuters - The Federal Reserves program to back emergency government loans to small businesses is fully operational the US. Under the TALF the Federal Reserve will lend on a non-recourse basis to holders of certain AAA-rated ABS backed by newly and recently originated consumer and small business loans. Businesses and nonprofits will be able to borrow a minimum of 100000 from the facility down from 250000 a move that might attract smaller businesses that dont need as hefty of a loan.

The Feds intervention to support the small-business lending fund comes in addition to the role it will already have in a larger stimulus scheme worth 454bn which will provide loans and loan. The Federal Reserve will expand loan offerings and qualification rules for its forthcoming 600 billion lending effort designed to reach small and midsize businesses hit by the coronavirus. The Federal Reserve is issuing this letter to inform supervised financial institutions about several forms of relief available to small businesses affected by COVID-19 as a result of the Coronavirus Aid Relief and Economic Security CARES Act.

On Wednesday Jan. The Federal Reserve has an ongoing interest in small businesses and their access to the credit they need to succeed and grow. Nonapplicants and applicants 23 nonapplicant use of financing and credit 24 nonapplicant loanline of credit sources 25 us.

29 2020 the Federal Reserve issues a statement and economic projections followed by a news conference with Fed Chair Jerome Powell. The Program terminated on January 8 2021. The Fed said it is reducing the.

The Federal Reserve has lowered the barriers on its lending program for smaller businesses as part of an effort to broaden the appeal of the sparsely used facility. The Federal Reserve established the Main Street Lending Program Program to support lending to small and medium-sized for profit businesses and nonprofit organizations that were in sound financial condition before the onset of the COVID-19 pandemic. Table of contents 14 applications 15 loanline of credit sources 17 loanline of credit approvals 19 lender challenges 20 applicant satisfaction 21 nonapplicants 22 financial challenges.

Most of the 113 respondents to the Federal Reserves Small Business Lending Survey reported that application approval rates remained stable but nearly 19 percent on net indicated a decline in credit quality amid tightening credit standards and loan terms. Small employer firm demographics 29 facilities. Small business loan originations by CRA respondents declined significantly between 2007 and 2010 and by 2016 have only recovered slightly.

In particular neighborhoods outside CRA assessment areas and neighborhoods with a high. As the small business credit market evolves prompting discussion about borrower protections the perspectives of small business owners are an important consideration. As the Federal Reserve Banks Small Business Credit Survey SBCS indicates nearly one-third 32 percent of small businesses that applied for credit in 2018 sought it from an online lender up from 19 percent and 24 percent in 2016 and 2017 respectively.

Central bank said on Thursday a boost to banks as they. The effort known as the Paycheck Protection Program is. New York CNN Business The Federal Reserve is changing the rules of its Main Street Lending Program to help smaller businesses that have been struggling to get by while waiting for additional.

1 While we do not have real-time data on the quickly changing small business conditions the 2019 Small Business Credit Survey sheds light on how firms are likely to remain afloat during this uncertain time. The Federal Reserve will lend an amount equal to the market value of the ABS less a haircut and will be secured at all times by the ABS. Nonbank online lenders are a growing source of small-dollar credit for small businesses.

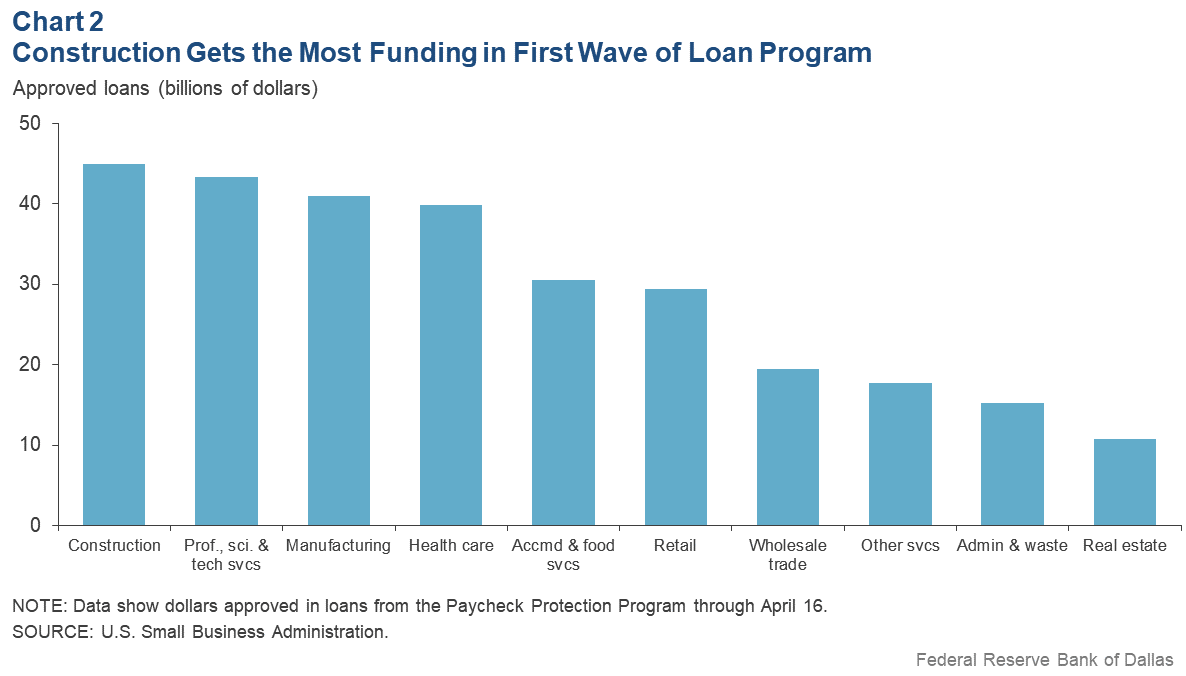

Treasury using the ESF will. Congress has dedicated 350 billion to make small business loans as part of the 2 trillion coronavirus support package it passed in March. AP PhotoJose Luis Magana File WASHINGTON -- The Federal Reserve said Monday it will support the governments 349 billion small business lending program which had a rocky start Friday.

Small Business Credit Survey May 2013 Key Findings

Small Business Credit Survey May 2013 Key Findings

The Federal Reserve To Take On More Risk To Aid Small Business Loan Program Axios

The Federal Reserve To Take On More Risk To Aid Small Business Loan Program Axios

Small Business Hardships Highlight Relationship With Lenders In Covid 19 Era Dallasfed Org

Small Business Hardships Highlight Relationship With Lenders In Covid 19 Era Dallasfed Org

A Tale Of The Ppp Tape Why Relationship Building Matters Journal Of Accountancy

A Tale Of The Ppp Tape Why Relationship Building Matters Journal Of Accountancy

Small Business Commercial Industrial Loan Balances Increase Year Over Year Federal Reserve Bank Of Kansas City

Small Business Commercial Industrial Loan Balances Increase Year Over Year Federal Reserve Bank Of Kansas City

Federal Reserve To Boost Small Business Lending Efforts

Federal Reserve To Boost Small Business Lending Efforts

64 Of Small Businesses Tell Federal Reserve They Need Aid To Survive Lane Report Kentucky Business Economic News

64 Of Small Businesses Tell Federal Reserve They Need Aid To Survive Lane Report Kentucky Business Economic News

When The Fed Tried To Save Main Street Cato At Liberty Blog

When The Fed Tried To Save Main Street Cato At Liberty Blog

Federal Reserve To Buy Small Business Loans Financial Times

Federal Reserve To Buy Small Business Loans Financial Times

Federal Reserve Moves To Pump Up Small Business Lending During Coronavirus Pandemic The New York Times

Federal Reserve Moves To Pump Up Small Business Lending During Coronavirus Pandemic The New York Times

Big Banks And Small Businesses Supporting Entrepreneurs Across America Financial Services Forum

Big Banks And Small Businesses Supporting Entrepreneurs Across America Financial Services Forum

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.