The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The top tax rate on long-term capital gains -- that is returns on the sale of stocks or other investments -- would increase to 396 from 20.

Biden To Propose A Big Change To Capital Gains Taxes This Is How They Work And Are Calculated Voice Press

Biden To Propose A Big Change To Capital Gains Taxes This Is How They Work And Are Calculated Voice Press

As the tables below for the 2019 and 2020 tax years show.

Cap gains tax. Its the gain you make. They are generally lower than. Rates would be even higher in many US.

Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being sold. Depending on your regular income tax bracket your tax rate for long-term capital gains could. Long-term capital gains on.

0 15 and 20. 0 15 or 20. When you include the 38 net investment income tax NIIT that rate jumps to 434.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and filing status. In the United States of America individuals and corporations pay US.

Long-term capital gains are usually subject to one of three tax rates. The tax rate depends on both the investors tax bracket and the amount of time the investment was held. Were going to get rid of the loopholes that allow Americans who make more than 1 million a year pay a lower rate on their capital gains than working.

The Capital Gains tax-free allowance is. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. Long-term capital gains are taxed at only three rates.

Currently all long-term capital gains are taxed at 20. 5 Zeilen If you realize long-term capital gains from the sale of collectibles such as precious metals. The top federal rate on capital gains would be 434 percent under Bidens tax plan when including the net investment income tax.

Long-term capital gains tax rates are 0 15 or. 7 Zeilen Capital gains tax is the tax you pay after selling an asset that has increased in value. States due to state and local capital gains taxes leading to a combined average rate of over 48 percent compared to about 29 percent under current law.

The first 1270 of taxable gains in a tax year are exempt from CGT. Calculate the capital gains tax on a sale of. Short-term capital gains are taxed at your ordinary income tax rate.

4 Zeilen A capital gains tax is a tax on the growth in value of investments incurred when individuals. Federal income tax on the net total of all their capital gains. Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021.

Remember this isnt for the tax return you file in 2021 but rather any gains you incur from January 1 2021 to December 31 2021. Capital Gains Tax can be more complex than the examples above. Short-term capital gains are taxed as ordinary income with rates as high as 37 for high-income earners.

For this reason you should get advice from Revenue see Further information below. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. Revenue also publishes a Guide to Capital Gains Tax.

12300 6150 for trusts You can see tax-free allowances for previous years.

متناسب الحسد نفس الشيء Short Term And Long Term Capital Gain Musichallnewport Com

متناسب الحسد نفس الشيء Short Term And Long Term Capital Gain Musichallnewport Com

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

Capital Gains Definition 2021 Tax Rates And Examples

/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png) Capital Gains Tax Definition Rates And Impact

Capital Gains Tax Definition Rates And Impact

Mechanics Of The 0 Long Term Capital Gains Rate

Mechanics Of The 0 Long Term Capital Gains Rate

النجار عدم الأمانة جدة Short Capital Gain Tax Musichallnewport Com

النجار عدم الأمانة جدة Short Capital Gain Tax Musichallnewport Com

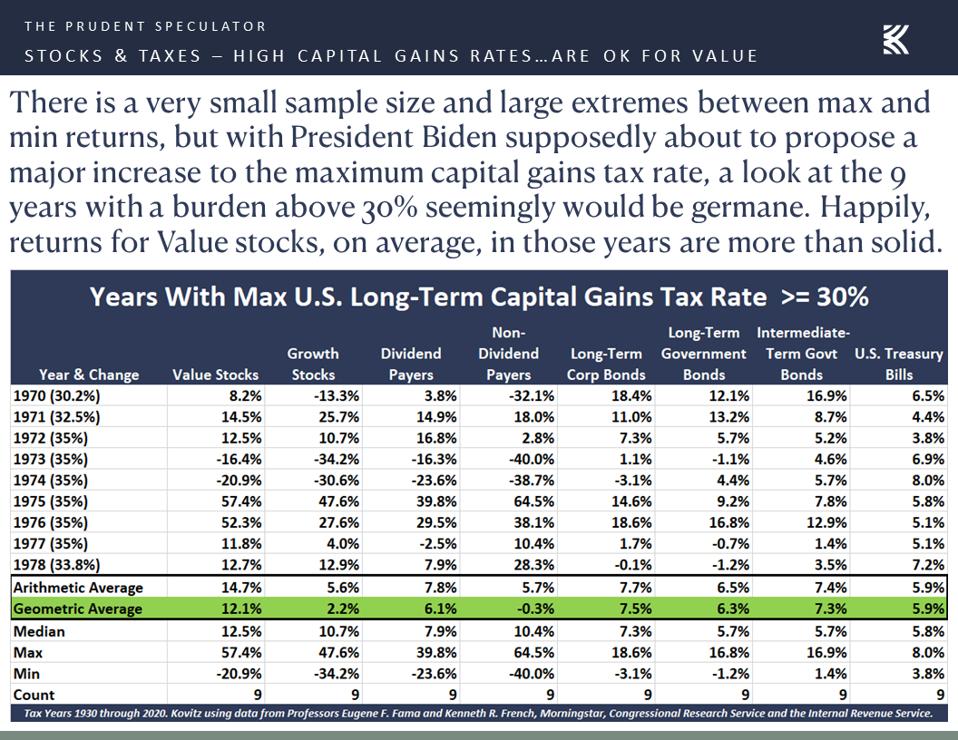

Just The Facts Ma Am What S The Truth When It Comes To Capital Gains Taxes And Returns Asian News

Just The Facts Ma Am What S The Truth When It Comes To Capital Gains Taxes And Returns Asian News

Don T Overpay The Irs On Your Minerals Capital Gains Tax Could Become Your New Best Friend Cowboy Minerals

Capital Gains Taxes Are Going Up Tax Policy Center

Capital Gains Taxes Are Going Up Tax Policy Center

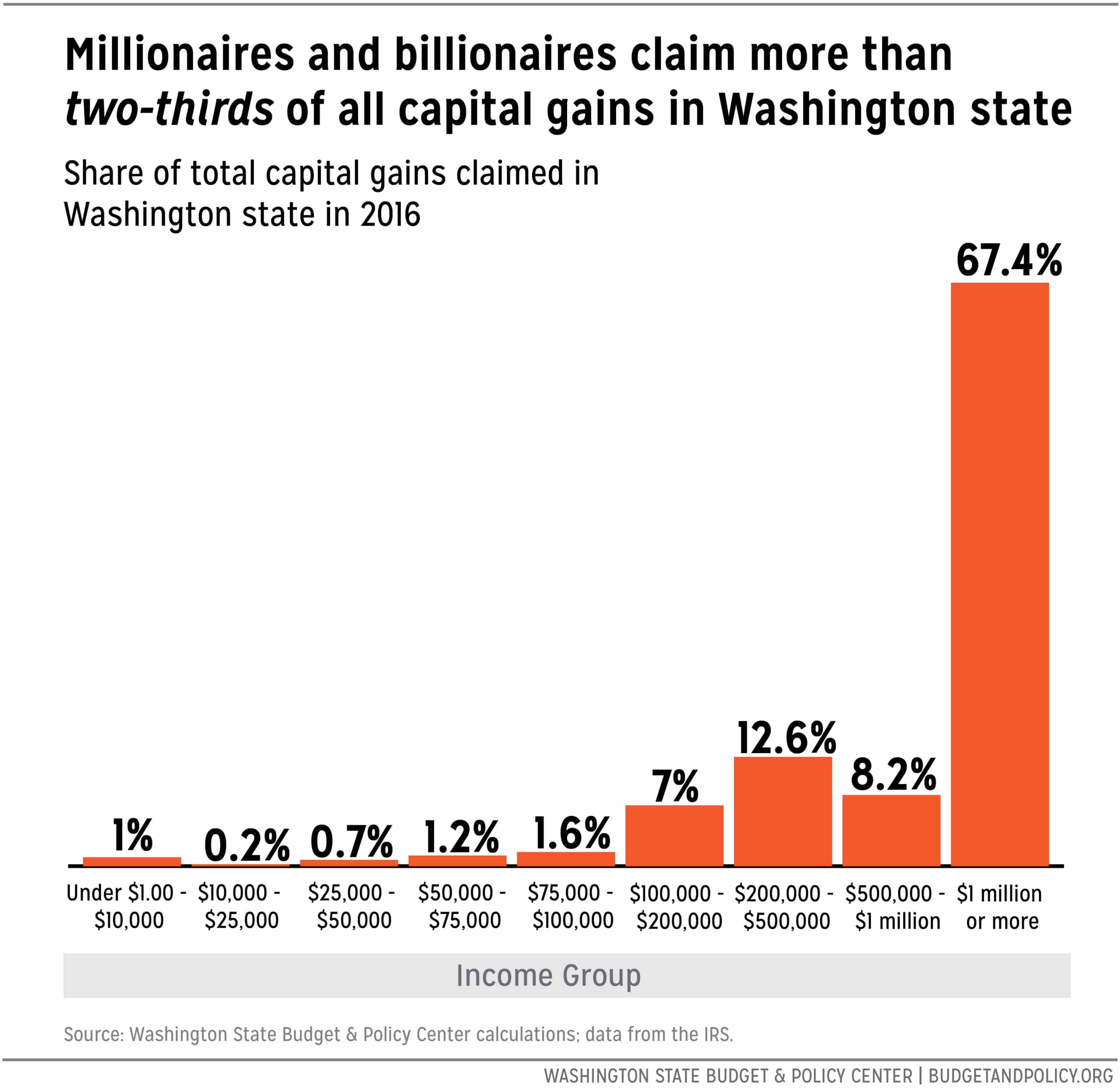

Capital Gains Tax Would Almost Exclusively Be Paid By Millionaires Billionaires Budget And Policy Center

Capital Gains Tax Would Almost Exclusively Be Paid By Millionaires Billionaires Budget And Policy Center

Capital Gains Tax Rate Chart 2014 Talat

Capital Gains Tax Rate Chart 2014 Talat

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Calculating Capital Gains Tax On The Sale Of Turkish Real Estate

Calculating Capital Gains Tax On The Sale Of Turkish Real Estate

How Roth Ira Conversions Can Escalate Capital Gains Taxes Financial Planning

How Roth Ira Conversions Can Escalate Capital Gains Taxes Financial Planning

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.