The Supreme Court ruling in South Dakota v. And remember that sales tax rates vary depending on your businesss location.

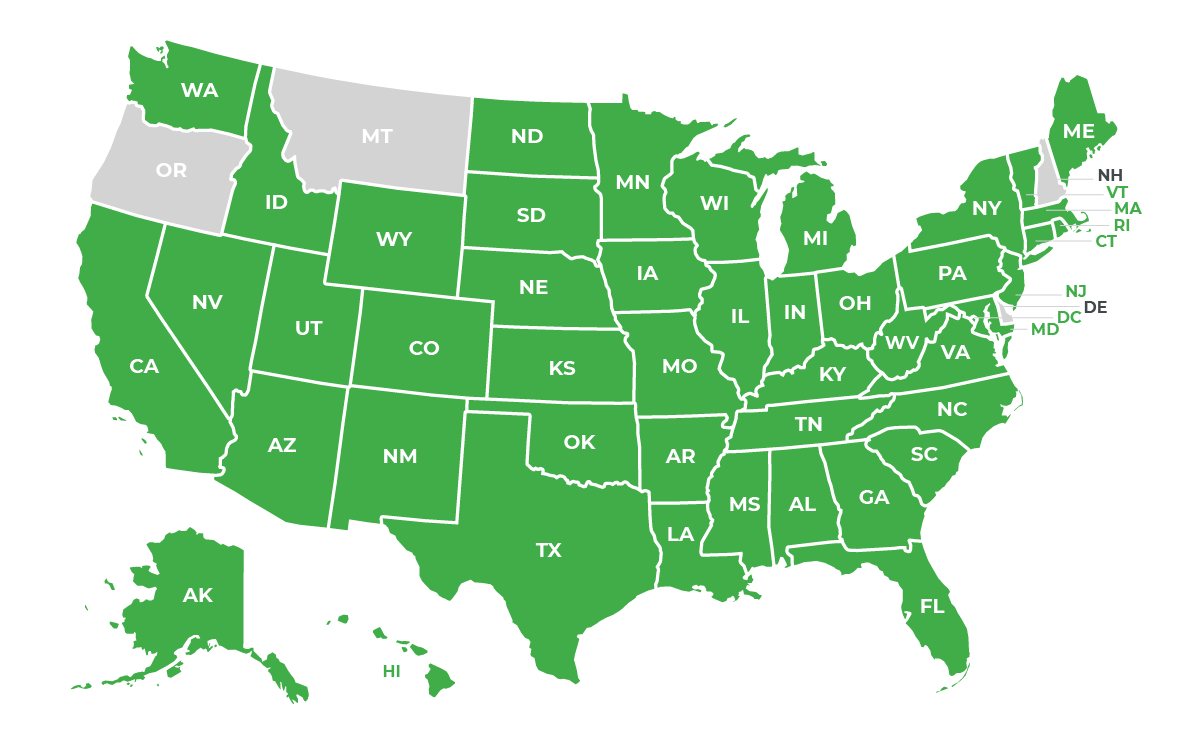

Online Sales Tax In 2021 For Ecommerce Businesses By State

Online Sales Tax In 2021 For Ecommerce Businesses By State

Once registered the state taxing authority will assign you a filing frequency.

Which states require sales tax for online sales. This can be a monthly quarterly or annual filing frequency. Keep in mind that Alaska Delaware Montana New Hampshire and Oregon do not have sales tax and therefore do not have any sales tax laws. New York has established which out-of-state sellers need to collect sales tax for orders placed by consumers within the state.

Most states will require only larger retailers to impose internet sales taxes. Youre responsible for collecting the correct and current sales tax rate on all sales that require that you collect sales tax. Some states also require sellers to pay online.

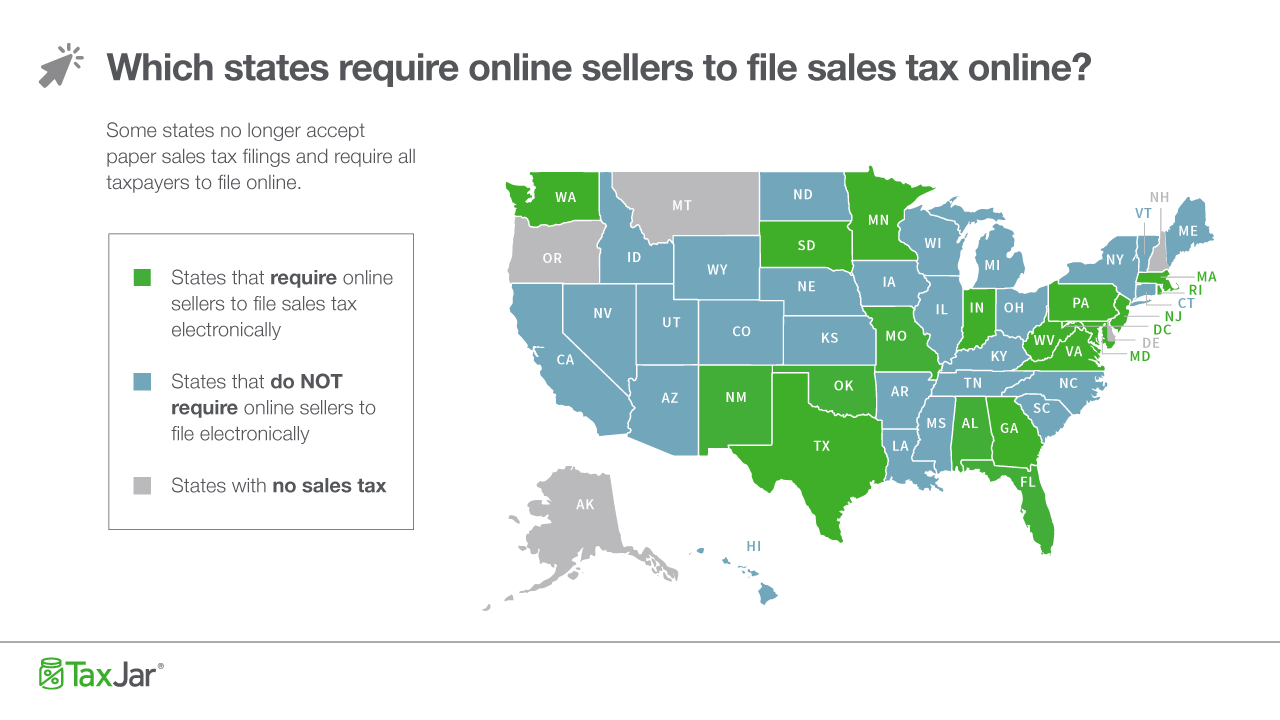

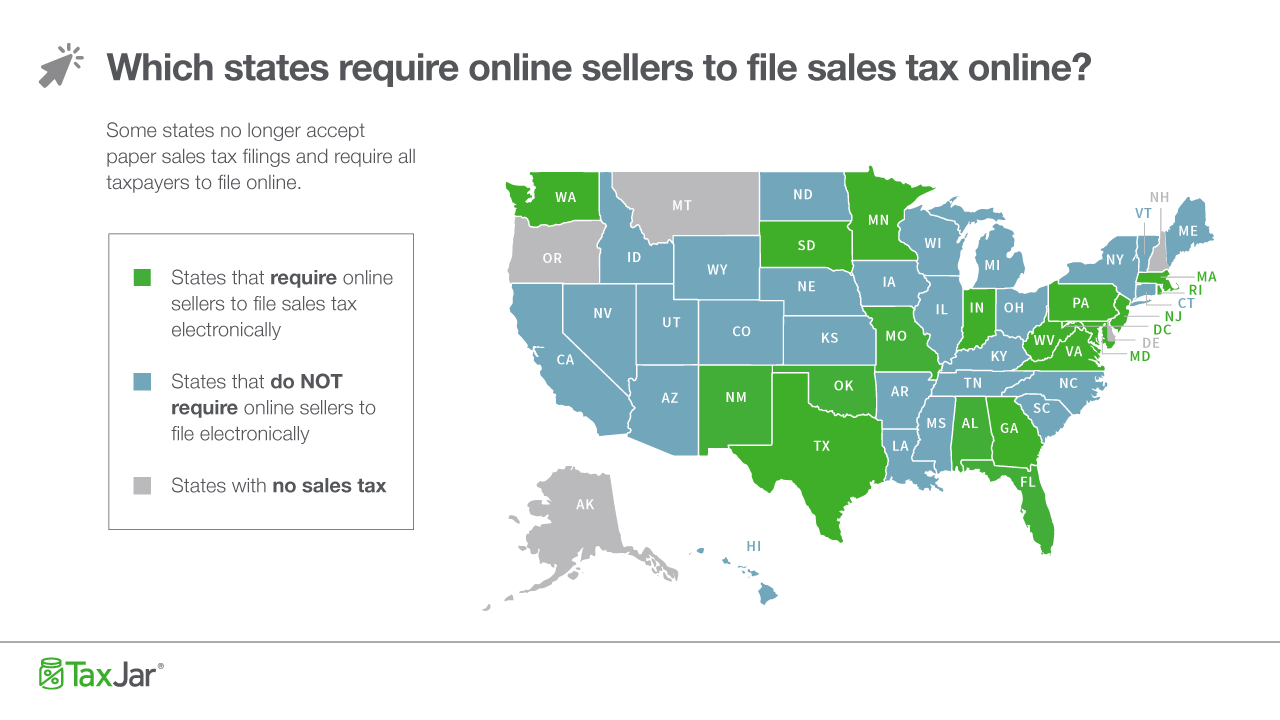

Remote multichannel seller. And sometimes a state that requires you to file online doesnt require you to pay online and vice versa. Most states do impose sales taxes but severallike Alaska and Oregondo not.

The legislation provides a safe harbor for small sellers. Only the state sales tax needs to be accounted for. But as with everything sales tax theres another layer to this onion.

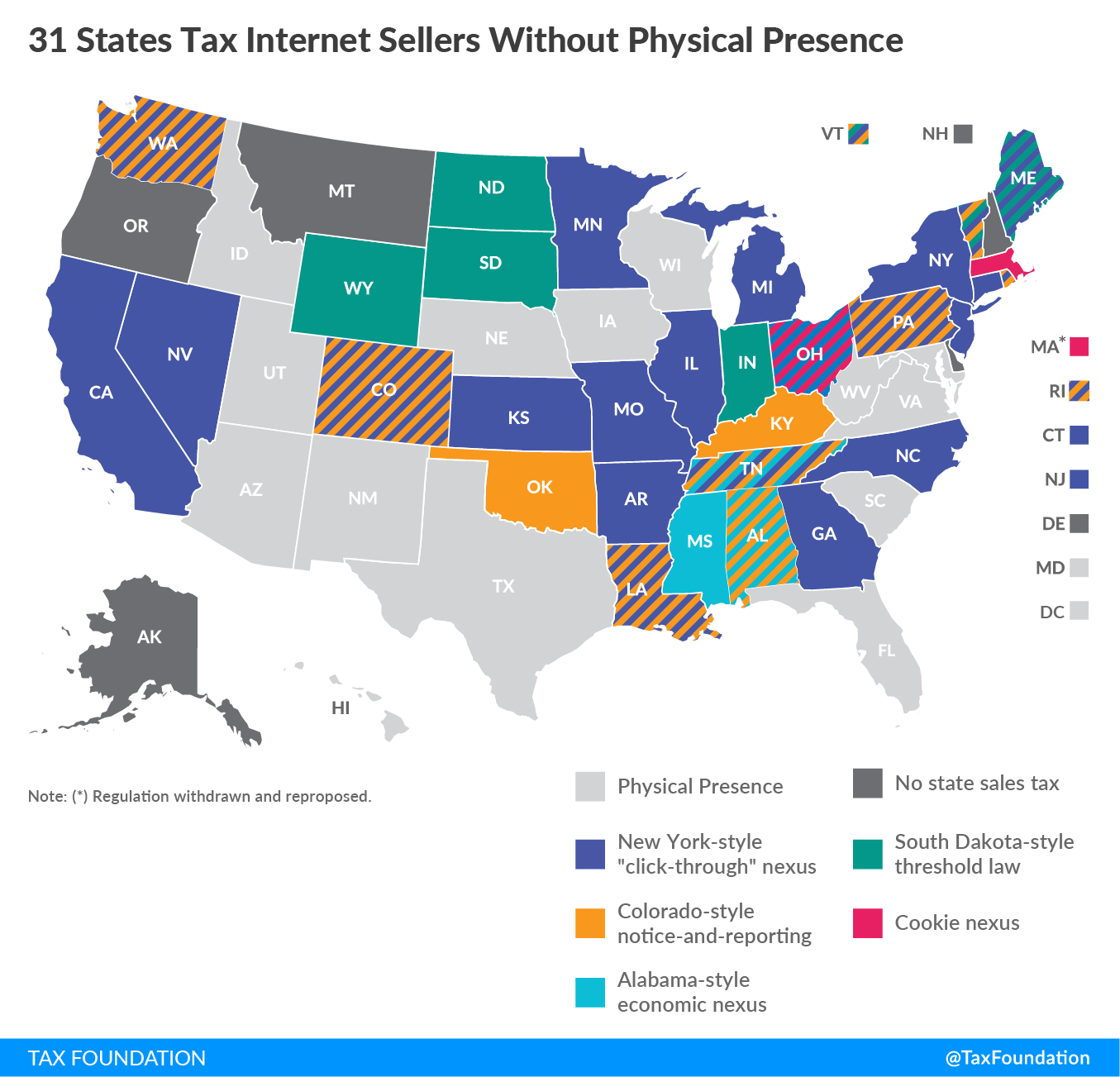

Some cities and towns charge an additional sales tax. Wayfair Inc established that individual states can require ecommerce retailers to collect state sales tax on the goods they sell. All states require a business selling taxable goods in their state to register at least 1-2 weeks prior to selling.

As of June 21 2018 the United States Supreme Court changed the laws regarding the collection of sales tax by internet sellers. Currently five states - Delaware Montana New Hampshire Alaska and Oregon - have no state sales taxes so if you do business in those states you dont have to worry about this issue. All have a sales tax.

Currently the states position is that the mere use of the Internet as a vehicle for. Looking strictly at the South Dakota economic nexus legislation addressed in the case South Dakotas law minimizes the burden on online and out-of-state sellers. States now have right to require tax collection from online retailers and other remote sellers that do not have physical presence in their states.

Youre required to register with the Louisiana Sales and Use Tax Commission for Remote Sellers Commission within the Department of Revenue DOR and collect Louisiana sales tax on sales not taxed by a marketplace provider if you cross the economic nexus threshold. Oklahoma Sellers are required to file sales tax online only if they owed an average of 2500 or more per month in total sales taxes in the previous fiscal year. Each state usually has an online database with current sales tax rates.

If youre online seller trying to decide if you need to collect sales tax first determine if your home state has a sales tax at all. Sales tax laws by state Below is a state-by-state breakdown of sales tax laws and rules. Pennsylvania Sellers are required to file sales tax online only if they followed 10 or more sales tax returns in the previous calendar year.

As one of the NOMAD states Delaware has no state sales tax. Unlike most other states that have put online sales tax rules or laws into effect New York isnt giving merchants any wiggle room as the rules are in effect immediately. Alaska Delaware New Hampshire Montana Oregon.

States set a sales tax rate and then localities can add a percentage on top of those rates. No state sales tax. Connecticut does also recognize marketplace facilitators who must register with the Department of Revenue and Sales for a permit.

Sales tax is a consumption tax meaning that consumers only pay sales tax on taxable items they buy at retail. Sales tax rates can change at virtually any time with different rates in each state county and city so its important to keep on top of them. States and Washington DC.

The Quill case prohibited states from requiring a business to collect sales tax unless the business had a physical presence in the state. For example in the 90210 zip code the tax rate is the 6 California state-wide rate a 25 Los Angeles County rate and an additional 325 local rate for a total of a 95 sales tax. Sales tax is a small percentage of a sale tacked on to that sale by an online retailer.

For many years states argued that they were losing a lot of money by not being able to collect sales tax on Internet sales to customers located in their states. The following states do not have an Internet sales tax. We often write about states that require sellers to file sales tax online click the link for a list.

Registration gets your business an official sales tax license.

The Seller S Guide To Ecommerce Sales Tax

The Seller S Guide To Ecommerce Sales Tax

3 Ways To Still Avoid Sales Tax Online

Post Wayfair Options For States South Dakota V Wayfair Tax Foundation

Post Wayfair Options For States South Dakota V Wayfair Tax Foundation

Internet Sales Tax And How It Affects Your Business Ryan Design Studio

Internet Sales Tax And How It Affects Your Business Ryan Design Studio

Should Congress Act Before Scotus On Online Sales Taxes Tax Foundation

Should Congress Act Before Scotus On Online Sales Taxes Tax Foundation

Holiday Wish List U S States Count On Extra Online Sales Tax To Boost Budget Reuters

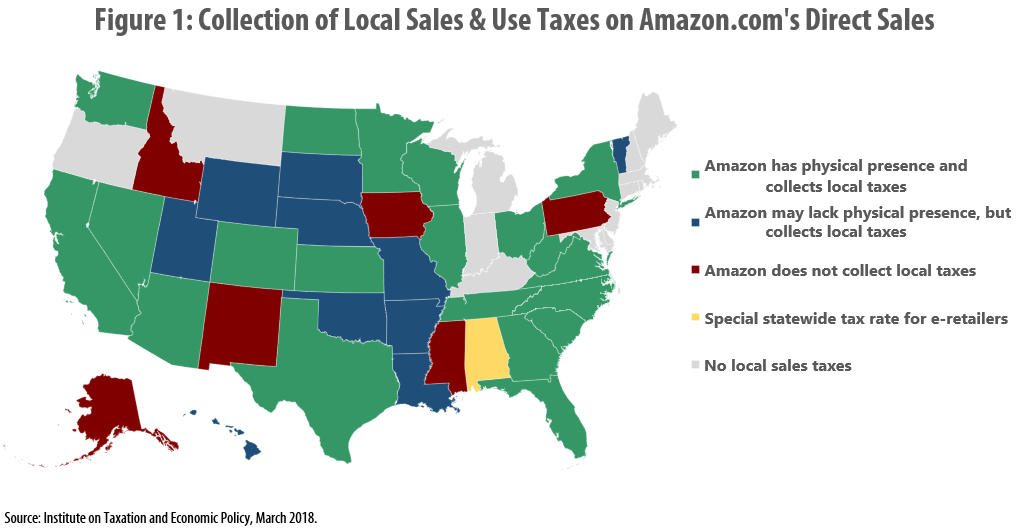

Many Localities Are Unprepared To Collect Taxes On Online Purchases Amazon Com And Other E Retailers Receive Tax Advantage Over Local Businesses Itep

Many Localities Are Unprepared To Collect Taxes On Online Purchases Amazon Com And Other E Retailers Receive Tax Advantage Over Local Businesses Itep

2019 Internet Sales Tax Updates For Economic Nexus

2019 Internet Sales Tax Updates For Economic Nexus

Which States Require You To File Sales Tax Online Taxjar Blog

Which States Require You To File Sales Tax Online Taxjar Blog

States That Make Amazon Pay Sales Taxes Wsj

States That Make Amazon Pay Sales Taxes Wsj

Big States Missing Out On Online Sales Taxes For The Holidays The Pew Charitable Trusts

Big States Missing Out On Online Sales Taxes For The Holidays The Pew Charitable Trusts

12 States Aren T Collecting Online Marketplace Sales Taxes This Holiday Shopping Season Don T Mess With Taxes

U S States Without Sales Tax 2021 Update Taxjar Blog

U S States Without Sales Tax 2021 Update Taxjar Blog

The Seller S Guide To Ecommerce Sales Tax

The Seller S Guide To Ecommerce Sales Tax

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.